What is a Fixed Asset? A fixed asset is a long-term part of a property that a company possesses and utilizes in the generation of its revenue and is not anticipated that would be devoured or consumed into cash in coming next one year. They are typically bought to generate income. They are also known as Capital Assets and Property, Plant and Equipment. These assets are normally not meant to sell or are not easily convertible into cash and therefore are categorized under non-current assets in the balance sheet. The assets accounts will then be overstated and depreciation programs for such missing unite of equipment will presumably continue. So, what discusses is: Understand Fixed Assets Accounting in Financial Management.

The Concept of Financial Management is to explain Fixed Assets Accounting for the Business.

Consequently, net income will be misstated because of the omission of losses on retirement of plant assets and because of erroneous depreciation charges. Unless internal controls over plant and equipment are carefully designed many units of equipment are likely to be broken, discarded or stolen without any entry being made in the accounting records for their disposal.

One important control device which guards against failure to record the retirement of assets is the use of controlling accounts and subsidiary ledgers for plant and equipment. The general ledger ordinarily contains a serpent assets account and related depreciation accounts for each major classification of plant assets, such as land, buildings, office equipment and deal very equipment.

For example,

The general ledger will contain the account office equipment and also the related accounts depreciation expense: office equipment and accumulated deportation: office equipment, the general ledger account, office equipment, contains entries for a variety of items: typewriters, filing cabinets, dictaphones, desks, etc..

It is not possible in this one general account to maintain adequate information concerning the cost of each item, its estimated useful life, book value, insured value, and another date which may be needed by management as a basis for decisions on such issues a replacement, insurance, and taxation.

A subsidiary ledger should, therefore, be established for office equipment, and for each of the other general ledger accounts which represent many separate units of plant property. The subsidiary ledger in a manual accounting system may consist of a hard life, with a separate card of each unit of property, such as a typewriter or desk.

Each card shows the name of the asset, identification number, and such as details as the date of acquisition, cost, useful life, depreciation, accumulated depreciation, insurance coverage, repair, and gain or loss on disposal. Every acquisition of office equipment is entered in the controlling account and also on a card in the subsidiary ledger.

Similarly, every disposal of an item of office equipment is entered in both be controlling account and the subsidiary ledger. Each card in a subsidiary ledger for plant and equipment shows an identification number which should also appear in the form of the metal tag attached to the asset itself. Consequently, a physical inventory of plant and equipment can be taken and will prove whether all units of equipment shown by the records are actually on hand and being used in operations.

Fixed Assets entry on Accounting Book:

The following are examples of fixed asset accounting:

- Land: Includes the purchased cost of land, and may also include the cost of land improvements.

- Buildings: Includes all facilities owned by the entity.

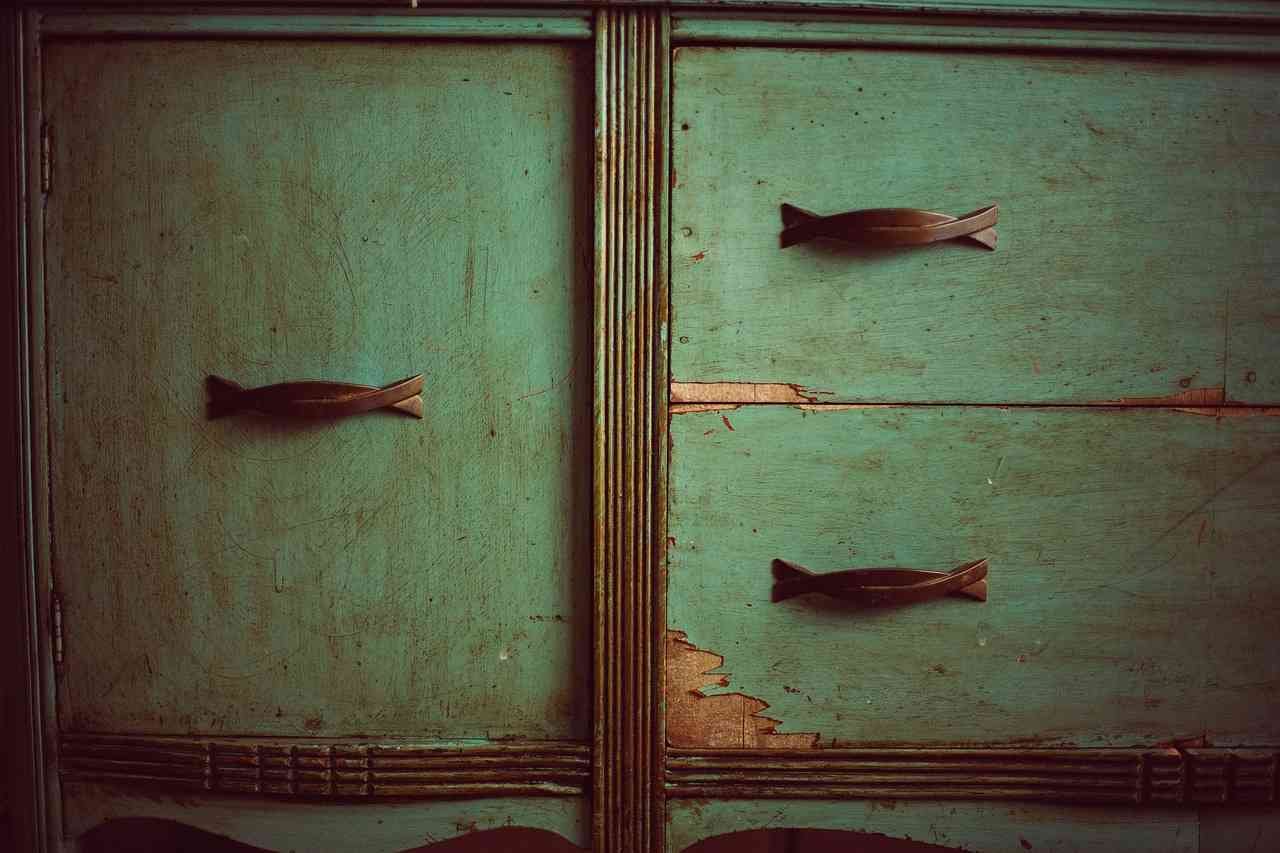

- Furniture and fixtures: Includes tables, chairs, filing cabinets, cubicle walls, and so forth.

- Machinery: Typically refers to production machinery.

- Vehicles: Can include company cars, trucks, and more specialized moving equipment, such as forklifts.

- Computer equipment: Includes all types of computer equipment, such as servers, desktop computers, and laptops.

- Computer software: Usually only includes the most expensive types of software; all others are charged to expense as incurred.

- Construction in progress: This is an accumulation account in which are recorded the costs of construction. Once an asset is completed, the balance is moved to the relevant fixed asset account.

- Intangible assets: Includes all nontangible assets, such as the costs of patents, radio licenses, and copyrights.

- Leasehold improvements: Includes the costs incurred to renovate leased space.

- Office equipment: Includes copiers and similar administrative equipment, but not computers.

Some Fixed Assets is explaining for better Understand:

The following assets are explained below are:

- Land.

- Buildings.

- Vehicles, and.

- Plant and Equipment.

Land:

Land used in the operation of a business should be recorded separately from land acquired as an investment or speculation. Procedures in accounting for the two types of land differ considerably.

Land held for business use appears on the balance sheet as a part of plant and equipment, and expenses associated with it are operating expense, whereas land acquired as an investment is classified with other investment assets, and applicable expense sometimes is capitalized, they are treated as non-operating or financial expenses.

Land acquired for use in the operation of a business should always be recorded separately from the building that may be located thereon. The principal reason for this is that the buildings are subject to depreciation, which must be treated as an operating cost, while it is not customary to take into consideration any depreciation on land in ascertaining the operating costs of a business.

In cases where an auditor finds land and building recorded in a single real estate account, he should recommend segregation of the land and buildings with a specific value on each. This will facilitate the computation of depreciation of building apart from the land.

Land is,

In a sense, the most permanent asset of a business, the auditor should ascertain that the land account is charged with (1) the original cost, (2) the expenses incident to the purchase, such as a cost of investigating the title, recording the deed, commissions paid, and any other expenses that represent an addition to the purchase price and (3) the cost of subsequent improvements that increase the value of the land, such as draining, grading, building approaches, assessments for sewers, and great improvements.

Not infrequently. Assessments for improvements charged off as current operating expenses. Such costs, however, should be charged to the land account. When land is sold. The land account should be credited with the cost price, while the difference between the cost and the selling price should be recorded separately as a loss or again. Under this procedure, the balance of the land account will always represent the original cost plus the cost of improvements of the land owned.

Buildings:

Buildings may be acquired through the purchase of real estate in which case separate values should be placed upon the buildings and land, the basis of the valuation being cost. In the preparation of annual should be valued at cost plus addition and improvements less the depreciation.

For balance sheet purposes, the buildings are generally listed at cost with the allowance for depreciation being deducted. The difference is extended as the book value of the buildings. Occasionally the question arises whether the accounts for buildings, as well as land and other types of plant and equipment should be marked up from the basis of cost to a higher current value determined by an appraisal.

In the audit of the buildings account the auditor should prepare working papers in which different buildings are segregated. These working papers should show the book values at the beginning of the period under audit the cost of additions or deductions during the period.

These beginning and ending balance should be checked with the amount of the building and ending balance on the balance sheet as both dates and should be in agreement with the account on the books.

If the subsidiary building ledger is maintained it should be compared with the controlling account in the general ledger to see that they agree all additions and deductions during the period should be carefully examined to be sure that they have been properly accounted for, due care being used to distinguish between capital and revenue expenditure.

Vehicles:

Every organization that has vehicles must have a vehicle politics. This will write down the policy on a range of cases such as:

- Insurance.

- Depreciation.

- Repair and Maintenance.

- Purchasing, disposal, and replacement.

- Private usage of it by staff.

- What needs to be done when an accident happens.

- Driver training and qualifications, and.

- Carrying the passengers.

The costs of replacement and repair must be good in the budget procedure. For every vehicle, there must be a record of journeys so that the operating costs per Km can be evaluated and private use closely monitored. Buying fuel for cash is risky, and it might be safer to establish an account with a reputable fuel company and pay every month by check instead.

Plant and Equipment:

Transactions that change the amount of investment in the plant and equipment of a business have a tendency to occur infrequently and to involve relatively large amount Current assets, on the other hand, are in the more or less fluid state, undergoing smaller changes constantly.

Although a company’s methods of internal accounting control generally apply to all transactions, whether they relate to current assets or to plant and equipment. the auditing procedures differ for the two groups.

In auditing current assets at the balance sheet date, the auditor is concerned with the balance on hand. changes that occurred during the year are not substantiated in detail except in audits designed as complete audits, With plant and equipment, the auditor is concerned with all changes that took place during the audit period regardless of the type of audit that is being performed ALL of any substantial amount that either increase or decrease the value of such assets must be examined.

Finally, Other advantages afforded by a plant and equipment ledger are the ready availability of information for the periodic computation of depreciation, and for entries to record the disposal of individual items of property. A better basis is also available for supporting the date in the tax return, for obtaining proper insurance coverage, and for supporting claims for losses sustained on the insured property.

In well-managed companies, it is standard practice to control expenditures for plant and equipment by preparing a budget of all planned acquisitions for at least a year in advance. A first essential to the preparation of such a budget is a detailed record showing the assets presently owned, their cost, age, and remaining useful life.

Leave a Reply