Operating margin Vs Gross margin measures a company’s profitability by calculating the ratio of operating income to net sales. It is also known as operating income margin, operating margin, earnings before interest and taxes (EBIT) margin, or return on sales (ROS). Businesses calculate operating margins by deducting the cost of goods sold (COGS), operating, depreciation, and amortization costs from net sales. Accounting software calculates and analyzes operating profit margins to help businesses visualize real-time revenue for every dollar of sales revenue.

What is the Operating margin Vs Gross margin? Importance and calculation formula

Operating profit = operating income – operating costs – taxes and surcharges – sales expenses – management expenses – financial expenses – asset impairment losses – credit impairment losses + gains from changes in fair value (-losses from changes in fair value) + investment income (-losses on investments ) + income from asset disposal (- loss from asset disposal) + other income

Operating profit ratio = (operating profit/operating income) × 100%. The operating profit ratio indicates the ability of the enterprise to obtain profits through production and operation. The higher the ratio, the stronger the profitability of the enterprise.

Extended information:

In addition to being affected by the income from sales of goods, the operating profit is also affected by the price difference between the purchase and sale of goods sold, tax on goods sales, variable expenses of goods sales, and fixed expenses that should be borne by goods sales. The impact of these factors on the profit of commodity sales can be expressed in the following way.

The Importance of Operating Margins

A company’s operating margin indicates the profitability of the core business and enables stakeholders to assess an organization’s ability to pay fixed costs such as interest and taxes. Operating margins are also critical for businesses looking to optimize resource allocation based on revenue forecasts.

How are stakeholders using operating profits to make decisions?

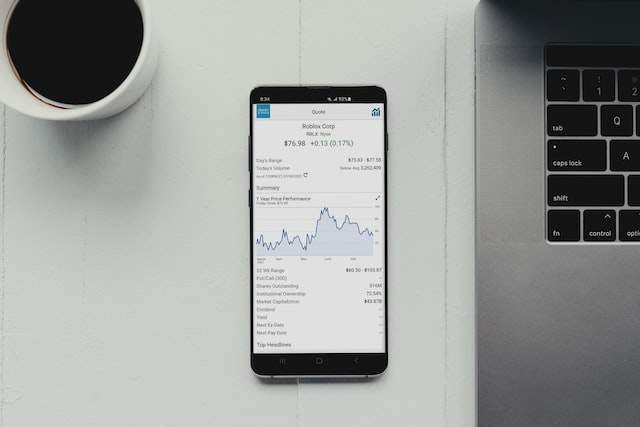

- Investors: Identify growing or shrinking profit and spending patterns

- Analysts: Assess stock value, and a company’s ability to pay for equity and debt investments

- Senior Leadership Team (SLT): Benchmarking the Competition with Operating Margin

- Managers: Gain insight into variable costs and decision effectiveness

Operating Margin Formula

The operating margin formula helps companies measure the overall business health and profitability of their core business. Business managers consider operating margin in conjunction with free cash flow, net profit, and gross profit.

Operating profit margin = (operating income – net sales income) X 100%

Operating income is the profit a business makes after deducting various expenses. Such as the cost of goods sold, general and administrative (G&A) expenses, depreciation, marketing, research and development, and other operating costs. Operating income helps a business determine net income before interest and taxes for a specific period. Net sales revenue is gross revenue or gross sales minus sales returns, discounts, and allowances. Net sales figures appear under direct costs on the income statement and are critical to an organization’s revenue growth.

What is a good operating margin?

Operating margins vary across industries due to varying levels of competition, efficiencies of scale, and capital structures. Operating efficiencies vary across industries, as do operating margins. That’s why it’s unfair to compare two different industries. Excellent operating margins that increase over time while remaining positive. Companies striving to achieve superior operating profit must improve unit economics and remain competitive and relevant.

What does gross margin mean?

The gross profit margin is an important indicator to measure the profitability of a company. Usually, the higher the gross profit margin, the higher the profitability of the enterprise and the stronger the ability to control costs.

This also reminds us that when choosing stocks, we can pay attention to the company’s gross profit margin. Companies in the same industry, when other indicators are close, choose companies with high gross profit margins as much as possible, and the probability of choosing a good company will be higher.

Gross profit margin refers to the proportion of how much money can be used for the next period after deducting the cost of sales from each yuan of sales revenue. The ratio of gross profit to merchandise sales revenue. Usually expressed as a percentage. It can be calculated by one commodity, or comprehensively by commodity category.

Refers to the percentage of gross profit in sales revenue, also referred to as gross profit margin, where gross profit is the difference between sales revenue and sales cost.

Calculation formula:

Calculation formula: gross profit margin = (operating income – operating cost) / operating income * 100%

Sales gross profit margin = sales gross profit / sales revenue × 100% = (sales revenue – sales cost) / sales revenue × 100%

The gross profit margin is an important indicator to measure the profitability of a company. Usually, the highest gross profit margin indicates that the higher the profitability of the enterprise, the stronger the ability to control costs.

How to Improve Operating Margins

A healthy operating margin is critical to financial stability. Companies with higher operating margins are less likely to be exposed to risk and will constantly seek to improve margins. These organizations use the following practices to increase their operating margins.

- Analysis category fees. Companies can improve operating margins by identifying key expenses from the business expense ledger and aligning these expenses with gross revenue.

- Create economies of scale. Identifying process integration opportunities is another great way to improve profits. This integration requires careful evaluation, analysis, and transformation of existing processes so that new processes generate more revenue.

- The pruning operation is wasteful. Conducting regular audits helps companies identify lengthy production processes and control the use of raw materials. Minimizing operational lag through the synchronization of production processes is key to improving the efficiency of business operations.

Operating Margin vs Gross Margin vs Net Margin

Operating margin evaluates operating efficiency by finding the company’s profit after variable costs are paid for. The metric does not take interest or taxes into account. Businesses looking to improve operating profits use resources efficiently, set product prices, and improve management controls.

Gross margin is the ratio of gross profit to total revenue. Gross margin analysis is an effective way to understand production efficiency and gross profit per dollar of revenue. Product-based companies regularly analyze gross margins to see improvements or declines in product margins over time. Net profit margin measures net income or profit per dollar of revenue. This metric is an excellent benchmark for evaluating a company’s ability to generate profits from sales, including overhead and operating costs.

What is the difference between gross profit margin and net profit margin?

Nature is different:

The gross profit rate is the ratio of the company’s gross income after removing the direct cost of the product (without removing the three fees and other costs such as income tax), so it is called the gross profit rate. The net interest rate is also the higher the long-term growth, the better. If the growth of net profit is faster than the growth of revenue, the net profit rate will increase, indicating that the company’s profitability is increasing; otherwise, it indicates that the company’s profitability may be declining.

Different meanings:

A high gross profit margin indicates that the company’s products are highly competitive in the market, which means that consumers are willing to pay a higher price than similar products to buy the company’s products. The net profit rate is also a good static indicator for assessing the management ability of the company management because only good management can gradually reduce the company’s three expenses, thereby saving more profits for the company and shareholders.

Different calculation methods:

Gross profit margin = gross profit / operating income × 100% = (main business income – main business cost) / main business income × 100%, net profit rate = net profit / main business income × 100% = (Total profit – income tax expenses) / main business income × 100%.