Explain and Learn, Promissory Note: Definition, Types, and Features!

A promissory note is a written contract that requires a borrower to pay back a lender an amount of money on a future date. The Concept of the study Explains – Promissory Note: Definition of Promissory Note, Types of Promissory Note, and Features of Promissory Note, Ten-Points, Ten-Key! A promissory note, sometimes referred to as a note payable, is a legal instrument, in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms. Also learned, Commercial Bills, Promissory Note: Definition, Types, and Features!

[3d-flip-book mode=”thumbnail-lightbox” urlparam=”fb3d-page” id=”55742″ title=”true” template=”short-white-book-view” lightbox=”dark”]

What is the definition of promissory note? Promissory notes usually refer to the borrower as the maker of the note. The borrower generally is said to have made the written agreement because he or she is initiating the transaction. The lender is referred to as the payee because it is the party that first pays the money to the borrower and then receives the payments at a future date. I know this is confusing. Just remember the maker is the borrower and the payee is the lender.

Businesses use notes to finance many different operations. Some companies use short-term notes to finance inventory purchases while other businesses use long-term notes to raise enough capital to purchase large equipment and machinery. Really this note is just a fancy way of saying a loan.

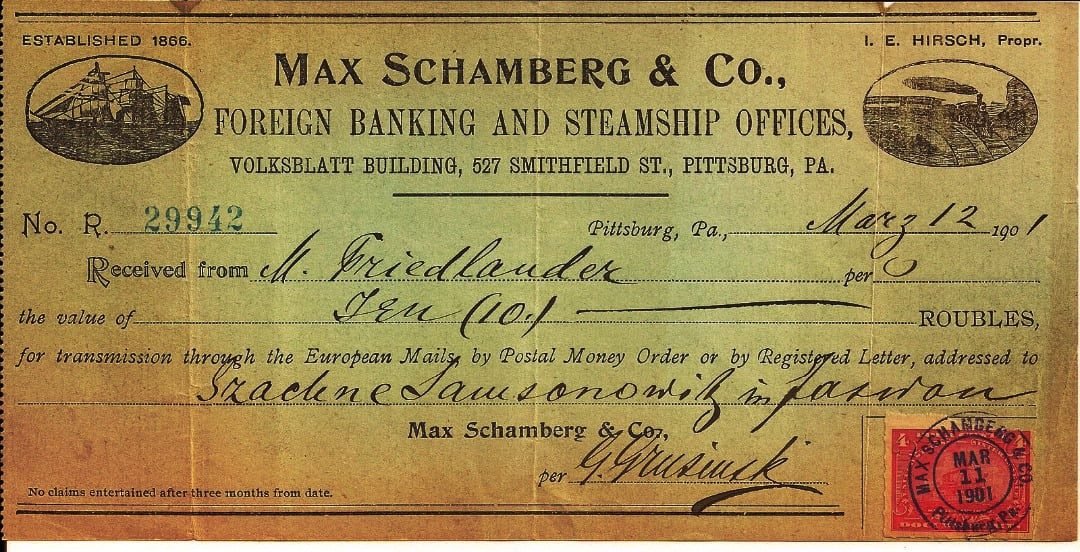

Promissory Note, in the law of negotiable instruments, the written instrument containing an unconditional promise by a party, called the maker, who signs the instrument, to pay to another, called the payee, a definite sum of money either on demand or at a specified or ascertainable future date. The note may be made payable to the bearer, to a party named in the note, or to the order of the party named in the note.

A promissory note differs from an IOU(An IOU (abbreviated from the phrase “I owe you“) is usually an informal document acknowledging debt) in that the former is a promise to pay and the latter is a mere acknowledgment of a debt. A promissory note is negotiable by endorsement if it is specifically made payable to the order of a person.

Definition:

A promissory note is a written agreement to pay a specific amount to specific party at a future date or on demand. In other words, it’s a written loan agreement between two parties that requires the borrower to pay the lender on a day in the future. This could be a set date or a date chosen by the lender.

According to section 4 of the Negotiable Instruments Act, 1881, a promissory note means “Promissory Note is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to, or to the order of, a certain person, or to the bearer of the instrument.”

A promissory note is a written and signed contract in which one party promises to pay a specified amount of money to the other party. The terms of a promissory can be tailored to the parties’ needs, as far as the amount borrowed, whether interest will be charged, the schedule or date by which the money must be repaid, and any other needed particulars.

There is no requirement that a promissory note is made on a certain type of paper or document, or that it contains complex language, though it is important to be as specific as possible. In fact, a promissory written and signed on a scrap piece of paper, back of a napkin, or even in an email or text message, is just as valid as a note drawn up by a lawyer.

Types of Promissory Note:

Though every good promissory note contains certain elements, there are several types of promissory note. These notes are largely classified by the type of loan issued or purpose for the loan. All of the following types of the promissory note are legally binding contracts.

- Personal Promissory Note: This type is used to record a personal loan made between two parties. While not all lenders use legal writings when dealing with friends and family, it helps avoid confusion and hurt feelings later. A personal promissory note shows good faith on behalf of the borrower, and provides the lender with recourse should the borrower fail to pay back the loan.

- Commercial Promissory Note: A commercial promissory note is typically required with commercial lenders. Commercial promissory notes are often more strict than personal notes. If the borrower defaults on its loan, the commercial lender is entitled to immediate payment of the full balance, not just the past due amount. In most cases, the lender on a commercial promissory note can place a lien on the borrower’s property until payment in full is received.

- Real Estate Promissory Note: A real estate promissory note is similar to a commercial note, as it often stipulates that a lien can be placed on the borrower’s home or other property if he defaults. If the borrower does default on a real estate loan, the information can become public record.

- Investment Promissory Note: An investment promissory note is often used in a business transaction. Investment promissory notes are exchanged to raise capital for the business, and they often contain clauses that deal with returns on investments for specific periods of time.

Features of a Promissory Note:

- The promissory note must be in writing- Mere verbal promises or oral undertaking does not constitute a promissory note. The intention of the maker of the note should be signified by writing in clear words on the instrument itself that he undertakes to pay a particular sum of money to the payee or order or to the bearer

- It must contain an express promise or clear undertaking to pay- The promise to pay must be expressed. It cannot be implied or inferred. A mere acknowledgment of indebtedness is not enough.

- The promise to pay must be definite and unconditional- The promise to pay contained in the note must be unconditional. If the promise to pay is coupled with a condition, it is not a promissory note.

- The maker of the pro-note must be certain- The instrument should show on the fact of it as to who exactly is liable to pay. The name of the maker should be written clearly and ascertainable on seeing the document.

- It should be signed by the maker- Unless the maker signs the instrument, it is incomplete and of no legal effect. Therefore, the person who promises to pay must sign the instrument even though it might have been written by the promisor himself.

- The amount must be certain- The amount undertaken to be paid must be definite or certain or not vague. That is, it must not be capable of contingent additions or subtractions.

- The promise should be to pay money- The promissory note should contain a promise to pay money and money only, i.e., legal tender money. The promise cannot be extended to payments in the form of goods, shares, bonds, foreign exchange, etc.

- The payee must be certain- The money must be payable to a definite person or according to his order. The payee must be ascertained by name or by designation. But it cannot be made payable either to bearer or to the maker himself.

- It should bear the required stamping- The promissory note should, necessarily, bear sufficient stamp as required by the Indian Stamp Act, 1889.

- It should be dated- The date of a promissory note is not material unless the amount is made payable at the particular time after date. Even then, the absence of date does not invalidate the pro-note and the date of execution can be independently proved. However to calculate the interest or fixing the date of maturity or lm\imitation period the date is essential. It may be ante-dated or post-dated. If post-dated, it cannot be sued upon till ostensible date.

- Demand- The promissory note may be payable on demand or after a certain definite period of time.

- The rate of interest- It is unusual to mention in it the rated interest per annum. When the instrument itself specifies the rate of interest payable on the amount mentioned it, interest must be paid at the rate from the date of the instrument.