Discover the key differences between index funds vs mutual funds. Learn how these pooled investment vehicles differ in management style, cost structure, performance tracking, investment strategies, and risk factors. Make informed investment decisions by understanding their unique purposes and objectives within the financial markets.

Meaning of Index Funds vs Mutual Funds

What Are the Main Differences Between Index Funds and Mutual Funds? Index funds and mutual funds represent two distinct investment vehicles, each serving unique purposes within the financial markets. Both types facilitate pooled investment strategies, providing individual investors access to diversified portfolios typically managed by professionals. However, the fundamental operations and objectives of index funds and mutual funds differ significantly.

Index funds are a type of passive investment fund designed to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. The main goal of an index fund is to match, not outperform, the index it tracks by holding the same securities in proportionate weight. This passive management approach results in lower operating expenses, as it requires minimal trading activity and less frequent portfolio adjustments. Consequently, index funds are often lauded for their cost-efficiency and simplicity. Making them an attractive option for long-term, risk-averse investors seeking steady growth.

Conversely, mutual funds encompass a broad category of investment funds that can be actively or passively managed. Actively managed mutual funds deploy portfolio managers who engage in security selection and market timing. Aiming to outperform specific benchmarks through tactical investment decisions. This active management strategy incurs higher fees due to research, transaction costs, and management salaries. Mutual funds can cover various investment objectives, including growth, income, or capital preservation, depending on the fund’s mandate.

The uniqueness of mutual funds lies in their diverse strategies and customization, catering to different investor preferences and risk appetites. They may invest in a mix of stocks, bonds, and other securities, offering a wide range of investment options within a single fund. In contrast, index funds’ focus remains on mirroring the performance of predefined indices, with a straightforward, transparent investment strategy.

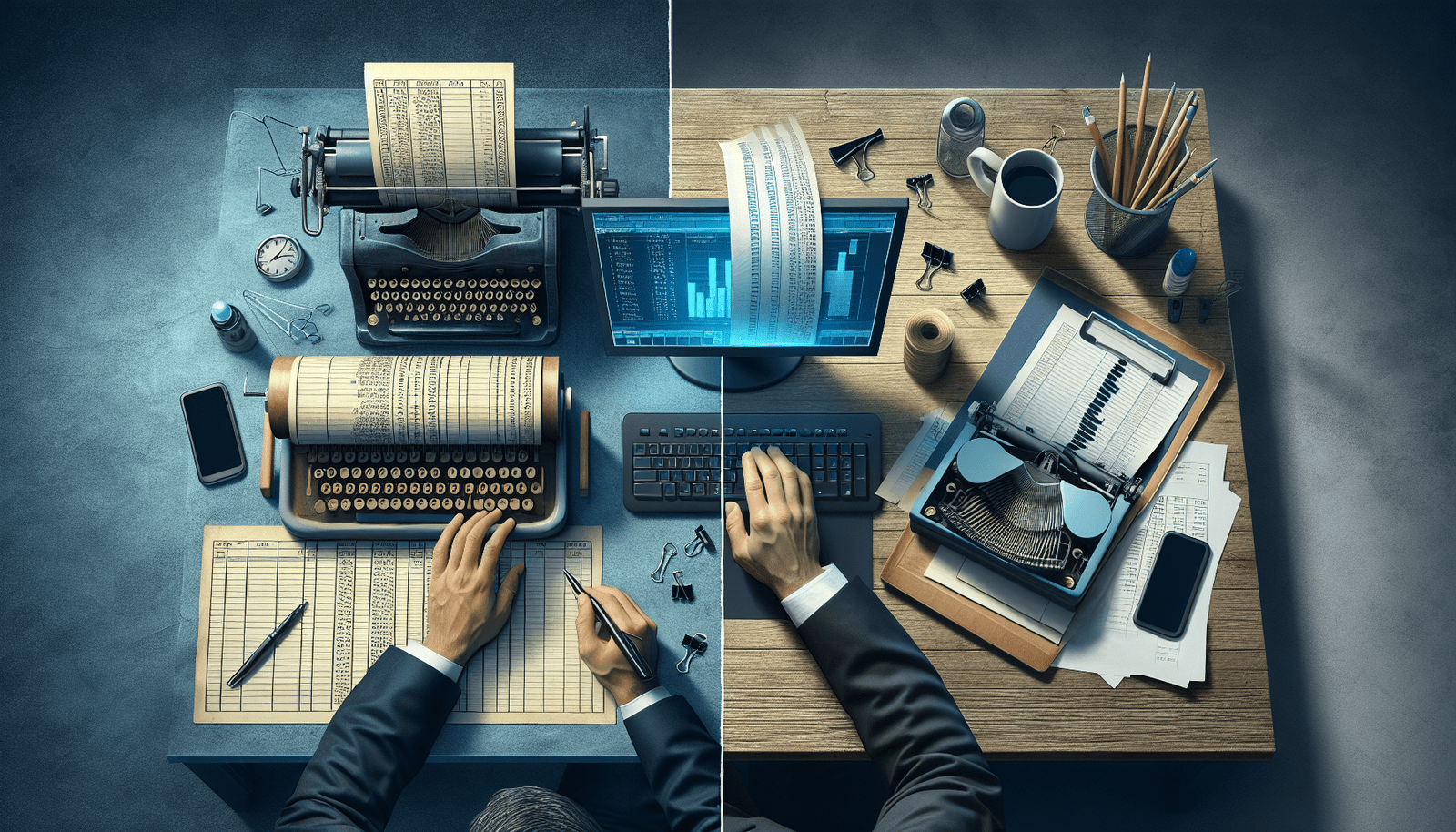

In essence, the primary distinction between index funds and mutual funds hinges on their management style and investment goals. While index funds aim for cost-effective market replication. Mutual funds seek to achieve targeted performance outcomes aligned with the investors’ specified objectives through active management.

Definition of Index Funds vs Mutual Funds

When making investment decisions, understanding the fundamental distinctions between index funds and mutual funds is crucial. Both pooled investment vehicles, but their strategies, management, and objectives differ significantly.

Index Funds aim to replicate the performance of a specific market index, such as the S&P 500, Nasdaq-100, or the Russell 2000. The primary objective of an index fund is to match the rates of return of its benchmark index as closely as possible, rather than outperform it. This achieved through passive management, wherein the fund’s portfolio mirrors the components of the index it tracks. Due to the passive nature of managing an index fund. They generally have lower fees and expenses compared to actively managed funds. Index funds are ideal for investors who prefer a “buy and hold” strategy and are focused on long-term growth with a steady, predictable return profile.

Mutual Funds, on the other hand, are actively managed by professional fund managers. These managers make strategic decisions by selecting various investments, including stocks, bonds, and other assets, with the aim of achieving specific financial goals or outperforming the market. Unlike index funds, mutual funds do not strictly follow a preset benchmark. Instead, they rely on the fund managers’ expertise and analysis to pick investments that they believe will perform well. This active management typically involves higher operational costs, reflecting in higher fees and expenses borne by investors. Mutual funds cater to investors who seek tailored investment strategies and are willing to pay a premium for professional oversight and the potential for higher returns.

In conclusion, the primary differences between index funds and mutual funds lie in their management approach and objective. While index funds focus on replicating the performance of a market index through passive management. Mutual funds engage in active management to potentially outperform market benchmarks. These distinctions influence cost structures, investor returns, and overall strategies. Allowing investors to choose an option that aligns best with their financial goals and risk tolerance.

Comparison Table of the Differences Between Index Funds vs Mutual Funds

Understanding the distinctions between index funds and mutual funds is crucial for making informed investment decisions. The table below captures the core differences between these two popular investment vehicles.

| Aspect | Index Funds | Mutual Funds |

|---|---|---|

| Management Style | Managed passively to mirror the performance of a specific market index (e.g., S&P 500). The manager’s role is limited to maintaining the index’s composition. | Actively managed by professional fund managers who make ongoing decisions about asset allocation in an attempt to outperform market averages. |

| Cost Structure | Typically have lower expense ratios and management fees due to the passive management approach. | Generally have higher expense ratios and may include additional fees, such as sales commissions, reflecting the cost of research and active management. |

| Performance Tracking | Track the performance of a specific index. The goal is to replicate the index’s returns as closely as possible. | Aim to outperform their benchmarks through strategic investments, resulting in a potential for higher but less predictable returns. |

| Investment Strategies | Invest in a broad range of securities that constitute the chosen index. The strategy is based on market replication without active trading. | Employ various strategies ranging from growth to value investing, focusing on selecting individual securities that align with the fund’s objectives. |

| Risk Factors | Offer diversification that aligns with the index, leading to lower volatility relative to specific stocks but are still subject to market risks. | Carry risks related to the fund manager’s decision-making and investment choices, along with market risks. The performance is variable and can differ significantly from benchmarks. |

By delineating these differences, investors can better assess which type of fund aligns with their financial goals, risk tolerance, and investment strategy.

Key Differences Between Index Funds vs Mutual Funds

Understanding the key differences between index funds and mutual funds is pivotal for making informed investment decisions. One primary distinction lies in how these funds are managed. Index funds are passively managed, aiming to replicate the performance of a specific market index like the S&P 500. In contrast, mutual funds are actively managed by professional portfolio managers who make strategic decisions to outperform the market.

The nature of management directly influences cost implications. Index funds typically offer lower expense ratios due to reduced trading costs and administrative fees stemming from their passive management approach. On the other hand, mutual funds incur higher expenses, which include management fees, transaction costs, and potentially performance fees as well. These cost differences can significantly impact overall investment returns over time.

Potential returns also vary between the two types of funds. Index funds often produce consistent, reliable returns that closely mirror the performance of their benchmark indices. Mutual funds have the potential for higher returns due to the expertise of fund managers attempting to leverage market opportunities. However, this active approach also introduces a higher risk of underperformance compared to benchmark indices, making outcomes less predictable.

Risk profiles differ as well. Index funds generally exhibit lower volatility, as they are diversified across the entire index they replicate. This diversification can mitigate risk and provide more stable, long-term growth. Mutual funds, while also diversified, can carry higher risks due to the concentrated and often speculative nature of active management strategies. Factors such as market timing and stock selection can introduce additional risks, including higher variability in returns.

Investors must weigh these differences when deciding between an index fund and a mutual fund. Objectives such as risk tolerance, cost sensitivity, and return expectations should guide their decisions. Those seeking low-cost, steady growth might prefer index funds, while individuals willing to accept higher management fees to pursue potentially superior returns might opt for mutual funds. It’s crucial to align investment choices with overall financial goals and risk appetite.

Examples of Index Funds vs Mutual Funds

To better illustrate the differences between index funds and mutual funds, it is helpful to examine some prominent examples of each. Among index funds, the Vanguard 500 Index Fund and the SPDR S&P 500 ETF are two well-known options. The Vanguard 500 Index Fund seeks to replicate the performance of the S&P 500 index by investing in a diverse range of companies within the index. It offers broad market exposure and is often lauded for its low expense ratios and passive management style. Similarly, the SPDR S&P 500 ETF tracks the S&P 500 index and provides investors with accessible and cost-effective exposure to a substantial portion of the U.S. equity market.

Conversely, mutual funds, such as the Fidelity Contra fund and the PIMCO Total Return Fund, highlight a more active management approach. The Fidelity Contra fund is one of the largest actively managed mutual funds, targeting capital appreciation by investing primarily in equities that the fund manager perceives to be undervalued. The active management allows for strategic adjustments based on market conditions, potentially leading to higher returns for investors, albeit often with higher fees compared to index funds.

In contrast, the PIMCO Total Return Fund focuses on generating returns through strategic investments in global fixed income securities. Managed by the well-known firm Pacific Investment Management Company (PIMCO), this mutual fund emphasizes risk management and seeks to provide a total return that exceeds inflation plus the risk-free rate. The fund managers employ a robust, active management philosophy involving comprehensive market analysis and tactical adjustments to the fund’s holdings.

These examples underline the key distinctions between index funds and mutual funds: Index funds offer passively managed, cost-effective exposure to broad indices, whereas mutual funds provide actively managed, potentially higher-yielding but costlier opportunities. Understanding these variances can help investors align their strategies with their financial goals and risk tolerance.