Customer Services: In today’s society, commodities and products are emerging in an endless stream, and technology is constantly developing. Now, more than the appearance, technology, function, and material of commodities, and products, consumers, and customers care about the services behind the products. The quality of a product is important, but the service of the product is also essential. When a product fails, the quality of after-sales customer service is what customers value most, and publicity lies in customer service. It is the embodiment of emotion and respect between people and cannot replace by any product.

Here are the articles to explain, What does customer services are? for writing a good resume

Customer Service Specialist: Also known as an Account Manager, in simple terms, is the person who serves customers. Receive customer inquiries, help customers answer their questions, or undertake full-time customer service.

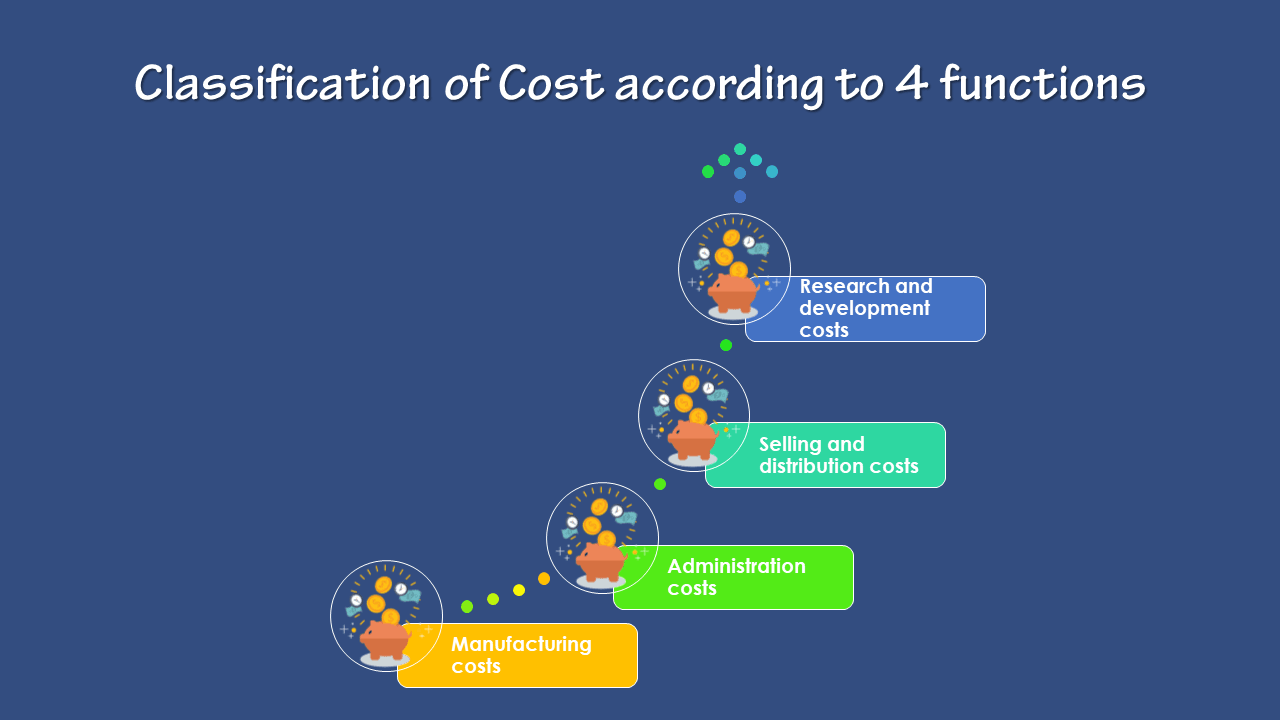

Classification of customer services;

Customer service divides into manual customer service and electronic customer service. Which can further subdivide into three categories: text customer service, video customer service, and voice customer service. Text customer service refers to customer service mainly in the form of typing chat, video customer service refers to customer service mainly in the form of voice and video, and voice customer service refers to customer service mainly in the form of mobile phones.

Customer service generally divides into three categories in business practice, namely: pre-sale service, in-sale service, and after-sale service. Pre-sales service generally refers to a series of activities that an enterprise provides to customers before selling products, such as market research, product design, providing instruction manuals, and providing consulting services.

In-sale service refers to the service provided by the seller to the buyer in the process of product transaction, such as reception service, commodity packaging service, etc. After-sales service refers to services that associate with the products sold and are beneficial to the characteristics of buyers, including services such as delivery, installation, product return, repair, maintenance, and technical training.

Customer Service Job Responsibilities;

- Accept customer inquiries, complaints, suggestions, and opinions, and make records;

- Collect customer and related market data, establish and manage customer files and information databases;

- Responsible for business coordination with relevant departments to solve problems raised by customers promptly;

- Quickly grasp the company’s new policies, and new business, and actively promote the company’s new products during the telephone service process, to encourage customers to have the willing to use the company’s products;

- Accept business applications and customer complaint calls and accurately record the content of complaints, and generate electronic work orders for businesses that require assistance from other positions and transfer them to the background team;

- Assist in arranging training materials within the group and coaching junior customer representatives. Participate in various pieces of training to improve overall quality. Participate in various team activities and support team building;

- For questions or materials that are not in the database, record the content of the question, hand it over to the assistant manager on duty and transfer it to the business team. Collect mobile business information in a timely and accurate manner, strive to learn mobile business knowledge, assist in collecting customer demand information, and put forward suggestions for improvement of service work;

- Use multi-channel methods (such as phone calls, text messages, emails, etc.) to communicate with customers to achieve service or sales purposes;

- Do a good job in user consultation and complaint handling, do a good job in reporting and dispatching users’ obstacles, and summarize and feedback on users’ suggestions and opinions;

Job Requirements

To be a qualified customer services staff, you should have a rigorous work style, enthusiastic service attitude, skilled business knowledge, positive learning attitude, patient explaining to customers, humble listening to customers’ opinions, etc.

Full of enthusiasm for work and serious work attitude. To be a qualified customer services staff, only if you love this career can you devote yourself to it. So this is a prerequisite for qualified customer service staff.

Proficient business knowledge. You should have the proficient business knowledge and keep studying hard. Only if you have mastered all aspects of business knowledge, you can accurately provide users with various services. Such as telephone bill inquiries, business inquiries, business handling, and complaint suggestions. Let customers get better service in satisfaction.

Answer questions patiently;

A qualified customer services staff, the core is the attitude to customers. In the process of work, you should maintain a warm and sincere working attitude. While doing a good job of explaining the work, you should be gentle and not arrogant or impetuous. If you encounter problems that customers do not understand or are difficult to explain, you must be patient. Do it again, until the customer satisfies, and always keep the promise of “melting smile into voice” and bringing sincerity to customers. In this way, you can better keep yourself moving forward.

Good communication and coordination skills;

Communication ability, especially effective communication ability is a basic quality of customer service staff. Customer service is the work of dealing with customers. Listening to customers, understanding customers, inspiring customers, and guiding customers are the basic skills when we communicate with customers. What kind of service and help do customers need, and where are the complaints and dissatisfaction of customers? Can we find out the problems existing in our company, prescribe the right medicine, and solve customer problems?

Work content

Customer data management

- Data collection: In the company’s daily marketing work, the collection of customer information is very important to work, which is directly related to the realization of the company’s marketing plan. The collection of customer services data requires customer service specialists to carefully extract customer information files every day to pay attention to the development of these customers.

- Data collation: The customer information files extracted by the customer services specialist are submitted to the customer service supervisor. The customer service supervisor arranges the information summary, analyzes and categorizes, assigns special personnel to manage various data, and requires daily updates to avoid omissions.

- Data processing: The customer service supervisor is assigned to the relevant customer service specialist by the principle of balancing the number of customers and taking into account business capabilities. The customer in charge of the customer services specialist should communicate with the customer within a week and make a detailed record.

Conduct irregular return visits to different types of customers

The needs of customers are constantly changing. Through return visits, we can not only understand the needs of different customers and market consultation but also find out the deficiencies in our work, make timely remedial and adjustments, meet customer needs and improve customer satisfaction.

Efficient complaint handling

Improve the complaint handling mechanism, pay attention to the standardization and efficiency of handling customer complaints, and form a closed-loop management process, so that complaints are accepted immediately, results are quickly obtained, and there is a return visit after handling; so that customer complaint can be efficiently and satisfactorily resolved. Create a complaint file.

Communicate closely with various departments, participate in marketing activities, and assist in market sales. The implementation of telemarketing by an enterprise plays an important role in the success of sales. Which requires customer service specialists to have certain sales business capabilities and master certain business skills.

Development Path;

Customer Service Specialist — Customer Service Supervisor — Customer Service Manager

How to do good customer service?

The ability to adapt to life without fear

Customer service staff needs to be resilient. As a customer service agent, you face different customers every day, and many times customers present you with some real challenges. For example, front-line customer service personnel, those who work in hotels, those who work in retail stores, those who are telephone operators, and those who are telephone customer service personnel, may encounter some challenging environments.

For example, a customer in a retail store complained. Maybe he drank a little wine and smashed the counter when he came in. What should you do as a customer services staff at this time? In this way, why is the customer so unreasonable? Hurry up and call the police, and some very experienced customer service staff can handle this matter safely. This requires a certain amount of resilience. Especially when dealing with some vicious complaints, it is necessary to be calm.

The ability to withstand setbacks

Salespeople often encounter some setbacks. What kind of setbacks can the customer service person suffer? For example, will you misunderstand the customer? Will you take anger on the customer service person? Because he has suffered too much, there needs to be an outlet. Therefore, customer service personnel need to have the ability to withstand setbacks.

Emotional self-control ability

What do you mean by self-control and the ability to regulate emotions? For example, if you receive 100 customers every day, you may scold by the first customer. So your mood becomes very bad and your mood is low. You don’t go home either, and the 99 customers behind are still waiting for you. At this time, will you transfer the unpleasantness that the first customer brought you to the next customer? This requires you to control your emotions and adjust your emotions. Because for the customer you are always his first. Therefore, the psychological quality of excellent customer service staff is very important.

The ability to support the full emotional effort

What is full emotional effort? It is that you provide the best service to every customer. I can’t have reservations, I can’t say it, because I need to laugh at 100 people today. And I guess I won’t be able to laugh for that long, so I should laugh less at the beginning. Is it okay to do customer service? No. You treat your first client with the same passion you need to treat your last client.

Positive and enterprising, never-give-up mentality ability

What is a good attitude of being proactive and never giving up? Customer service personnel need to constantly adjust in their jobs. The external ability of customer service personnel must be supported by an internal thing. The most important thing is literacy. So, what qualities do customer service personnel need to have? Take a look at “Qualities Necessary for Customer Service”

Some people are not service-oriented or their service-oriented is not strong enough. Once they choose a career in customer service, they will be very miserable, because they do not have the initiative to help others, and they will feel very uncomfortable every time they provide service to customers. On the contrary, if you are a person with a strong service orientation, you will find that service is a very happy thing, because you can feel happy by helping others every time, and you will regard the happiness of others as your happiness, take the elimination of other people’s troubles as your own greater happiness.

How to write a customer services resume?

First, double-check the written CV for typos, grammar, and punctuation. It’s best to have a good writer review it for you because others are more likely to spot errors than you. Customer service work requires staff to be careful. If there is such a low-level mistake in your resume, it will make HR a bad impression of you, and even cause HR to directly ignore your resume, and you will lose an interview.

Secondly, keep in mind that your resume must highlight the key points. It is not your autobiography. You should try not to write anything unrelated to the job you are applying for. Experience and experience that are meaningful to the job you are applying for must not miss. So, write about the experiences you’ve had about customer service work. For example, the following experience is good:

Of course, if you don’t have relevant work experience, you don’t need to be afraid. Let’s take a look at the following requirements for a company’s recruiting customer service:

- College degree or above from a national unified recruitment institution, with no restrictions on majors;

- Good image, good temperament, clear articulation, outgoing personality, cheerful and confident;

- Strong language skills and interpersonal communication skills;

- More than one year of sales experience or service marketing management experience and traditional advertising industry work experience is preferred;

- Proficient in using MS-office office software. Computer-level, outstanding graduates are preferred.

Other things

From the above description, we can see that the company does not have high requirements for the position of customer service, and students of any major can apply for this position. If it is a voice customer service, “articulate, outgoing, cheerful, and confident” is a must. So how do you reflect that you have the above abilities? You can write that you have served as the host of an activity in the school, participated in the school’s broadcast agency, or actively participated in the performance of various activities in the school.

These can well reflect that you are suitable for customer service in terms of oral expression and character. Yes; if you are applying for written customer service, you need to highlight your good written expression skills. Such as contributing to the school newspaper, writing some small words, and joining the school’s literary club, all of which can write into your resume. For example, Some customer service positions require face-to-face communication with customers.

At this time, you may require to have a “good image and good temperament”. Attaching a formal job search photo can bring a lot of extra points to your resume. Of course, If your appearance is more “graceful”, it is recommended not to attach photos, and the best job position is a customer service position that does not communicate with customer service face-to-face, to avoid reducing your chances of interviewing yourself due to some inherent disadvantages.