Ledger Merchant Account: The ledger system of double-entry bookkeeping includes the utilization of various record administered books (known as a bunch of books) to record exact data, in cash esteems, of every day exchanging activities of a business. Accounting essay present; Ledger Account is a diary where an organization keeps up the information of the relative multitude of exchanges and fiscal summary. The organization’s overall cartulary account coordinate under the overall cartulary with the monetary record grouped into various records like resources, Accounts receivable, creditor liability, investors, liabilities, values, incomes, charges, costs, benefit, misfortune, reserves, advances, bonds, stocks, compensations, compensation, and so forth.

Ledger Merchant Account: Meaning, Definition, Types, Features, Advantages, and Disadvantages.

Before understanding What ledger accounts are? Let us take a concise prologue to Ledger. Diary is utilized to record the exchanges sequentially. Yet, Journal just gives the impact of individual exchanges. The proprietor of a business, in any case, isn’t just keen on thinking about the impacts of individual exchanges on fiscal summaries yet also the gathered impact of each Account.

For instance, if he needs to know the aggregate sum of buys identifying with a specific bookkeeping period, at that point it will be a chaotic task to discover it from the Journal as it contains countless exchanges identifying with buys at better places as indicated by their particular dates of the event. In any case, he can without much of a stretch locate the number of all-out buys from the “Buys Account”. Subsequently, it requires that exchanges of a comparative sort should figure out and collected in one spot. This spot is a cartulary.

Meaning of Ledger Merchant Account:

What Does Accounting Ledger Mean? The notes or diary gives a total posting of the everyday exchanges of a business. Be that as it may, it doesn’t give data about a particular record in one spot. For instance, to realize how much money balance we have, the bookkeeping agent would need to check all the diary sections in which money includes, and this is an arduous work; because there are hundreds or even great many money exchanges recorded on various pages of the diary. To dodge this trouble, the charge and credit of journalized exchanges move to ledger accounts. Hence all the progressions for a solitary record are situated in one spot – in a cartulary account. This makes it simple to decide the current equilibrium of any record.

At the point when all the exchanges of a given period have been journalized, the following thing is to characterize them as per the records influenced. All comparative exchanges must unite. For example, all exchanges identifying with money must place in one spot. Likewise, all exchanges with a client or a provider must collect in one spot. The book in which this characterization do know as the ledger.

Definition of Ledger Merchant Account:

What is the Ledger in Business? The cartulary is a book that contains a consolidated and arranged record of the relative multitude of financial exchanges of the business by and large brought, moved, or posted from the books of unique section.

The cartulary knows as the ruler of all books of records since all sections from the books of unique passage must present on the different records in the ledger. It should notice that the diary contains a sequential record while the cartulary contains an ordered record, all things considered.

Kinds of Types of Ledger Merchant Account:

A cartulary is where all ledger accounts are kept up in a summed up manner. What are 3 different types of Ledger double entry? All records joined to make a cartulary book. A cartulary otherwise calls the chief book of records and it shapes a perpetual record of all business exchanges. Prevalently there are 3 unique types of the ledger – Sales, Purchase, and General ledger.

Sales Ledger or Debtor’s Ledger:

Deals or Sales Ledger is a cartulary where the organization keeps up the exchange of selling the items, administrations, or cost of merchandise offered to clients. This cartulary gives the possibility of deals with income and pays explanation. First among various sorts of ledgers is “Deals or Debtors’ ledger”.

It is a gathering of all records identified with clients to whom products have been sold using a loan (Credit Sales). The Sum of all the cash owed to a business by their clients appears here and name as Accounts Receivable, Trade Debtors, or Sundry Debtors. The records generally organize in sequential requests, be that as it may, these days all the cartulary accounts are kept up with the assistance of bookkeeping ERPs.

Purchase Ledger or Creditor’s Ledger:

Purchase or Buy Ledger is a cartulary where the organization puts together the exchange of buying the administrations, items, or products from different organizations. It gives the permeability of how much sum the organization paid to different organizations. It is a gathering of all records identified with vendors from whom products have been bought using a loan (Credit Purchases).

The Sum of all the cash owed by a business to their merchants is appeared here and name as Accounts Payable, Trade Creditors, or Sundry Creditors. The all-out money related sum inside the bought cartulary appears in the preliminary equilibrium and the asset report at its fitting spot.

General Ledger:

General Ledger isolates into two kinds – Nominal and Private Ledger. An ostensible cartulary gives data on costs, pay, deterioration, protection, and so on Also, a Private ledger gives private data like compensations, compensation, capitals, and so on Private ledger isn’t open to everybody. Organizations typically make a solitary general ledger which incorporates 2 extra subtypes of ledgers for example ostensible and private ledger.

These two might remember for the rundown for various sorts of ledgers in bookkeeping. An overall cartulary is a brought together gathering for all the cartulary records of a business. It contains a wide range of records which can find in an association; for example, resources, liabilities, capital or value, incomes, costs, and so forth

According to conventional or UK style bookkeeping; It comprises of all ostensible and genuine records important to plan financials for an organization. For example Building, Office hardware, Furniture, etc.

- Nominal Ledger: As the name recommends it contains all ostensible records for example cost, misfortunes, wages, and gains. Models – Salaries, Sales, Purchases, Returns Inward/Outward, Rent, Stationery, Insurance, Depreciation, and so on

- Private Ledger: They comprise records that are secret in nature, for example; capital, drawings, compensations, and so forth These records are just available by chosen people.

A few organizations do make separate general, ostensible, and private ledger.

Features or highlights or characteristics of Ledger Merchant Account:

The ledger has the following main characteristics or features:

- It has two indistinguishable sides – the left-hand side (charge side) and the right-hand side (credit side).

- The charge part of the relative multitude of exchanges record on the charge side; and, credit parts of the relative multitude of exchanges record on the credit side as per date.

- The contrast between the sums of the different sides speaks to adjust. The overabundance of the charge side over the credit side demonstrates charge balance; while an abundance of the credit side over the charge side shows the credit balance. On the off chance that the different sides are equivalent, there will be no equilibrium.

- For the most part, the equilibrium draws at the year-end; and, recorded on the lesser side to make the equivalent of the different side. This equilibrium knows as the end balance.

- The end equilibrium of the current year turns into the initial equilibrium of the following year.

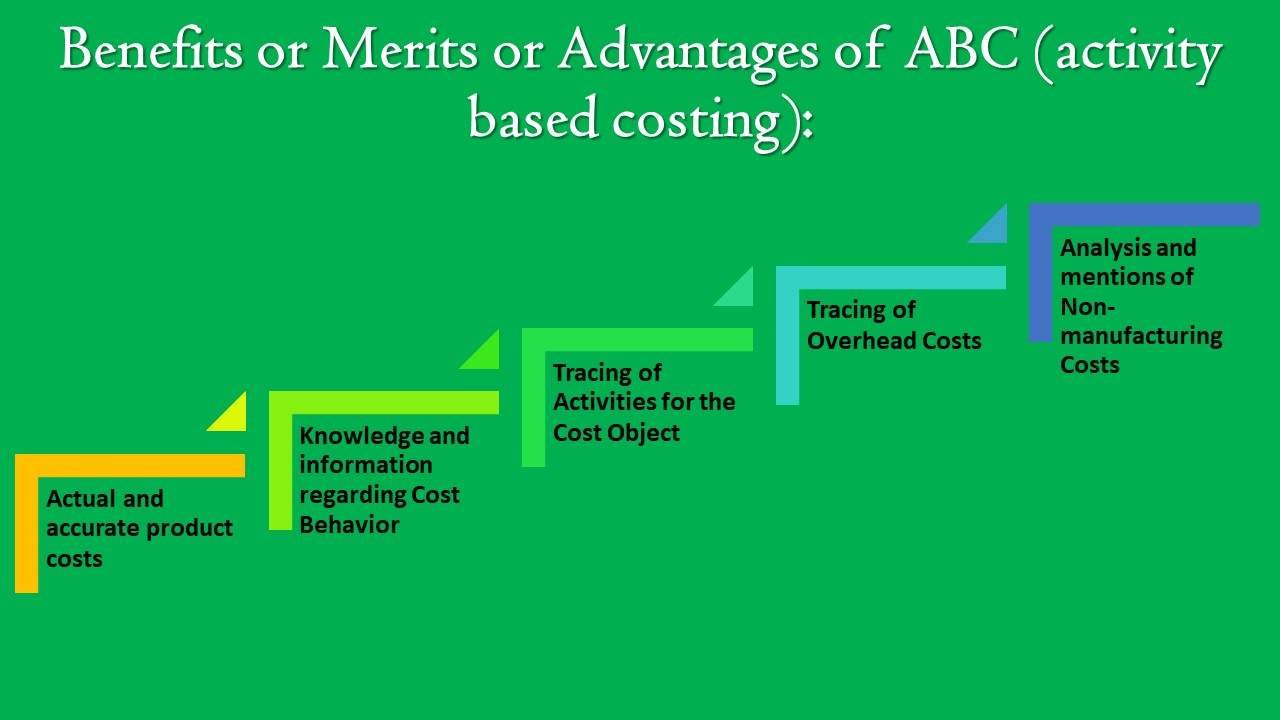

Merits or Benefits or Advantages of Ledger Merchant Account:

What are the advantages of Ledger double entry? Keeping up the ledger is an unquestionable requirement in each bookkeeping framework. It is important as will be obvious from its preferences.

- Exchanges identifying with a specific individual, thing, or heading of use or pay to assemble in the concern record in one spot.

- At the point when each record occasionally adjusts it mirrors the net situation of that account.

- Ledger is the venturing stone for getting ready Trial Balance – which tests the arithmetical exactness of the bookkeeping books.

- Since the sections recorded in the diary refer to in the cartulary the chance of mistakes of defalcations decreases to the base.

- Ledger is the objective of all sections made in diary or sub-diaries.

- Ledger is the “storage facility” of all data which consequently utilize for getting ready last records and fiscal summaries.

The accompanying focuses feature the best eight focal points of a ledger. The points of interest are:

The readiness of Trial Balance:

It is preposterous to expect to set up a Trial Balance without ledgers. Since a Trial Balance sees up by taking up the cartulary accounts balance. Besides, arithmetical precision is unimaginable.

Introducing Final Position:

We realize that the last record must see up from a Trial Balance (i.e., Trading Account, Profit and Loss Account, and Balance Sheet). In this way, on the off chance that we don’t get the cartulary accounts balance from a Trial Balance, we can’t plan last records.

Utilization of Double Entry System:

Twofold Entry System finishes just when we present the diaries on various cartulary accounts.

Deciding Results of Each Account:

The consequences of each record can get from the cartulary dependent on Double Entry standards.

Keeping up Classified Accounts Indirect Advantages:

The points of interest of grouped records might uncover in the wake of recording in the cartulary account appropriately.

Introducing Statistical Information:

The cartulary accounts with their separate adjust are the wellsprings of measurable data that utilize by the administration while dynamic.

Gathering Information:

The cartulary might know as the assortment or storeroom of different exchanges.

Present Financial Position:

The monetary situation of an endeavor (i.e., after setting up the last record) must know whether we keep up the cartulary account appropriately.

Demerits or Limitations or Disadvantages of Ledger Merchant Account:

As Merchant Account Keeping up the ledger is an unquestionable requirement in each bookkeeping framework. Its disadvantages will be obvious from its preferences;

- Ledger is dependent on the journal entry, they are not working independently. It is fully helpless without journal data.

- They are not opening entry while closing entry, and also they analyze from the fixed data record.

- Ledger is a system of double-entry bookkeeping; but, some data is both side columns belong as cash or bank or name is all depend on credit or debit entry.