Making a trial balance is essential for accurate accounting. This step-by-step guide breaks down the process, highlights its importance, and offers tips to ensure your financial records are balanced, providing clarity for your business’s financial health.

Make a Trial Balance: Your Step-by-Step Guide to Financial Harmony

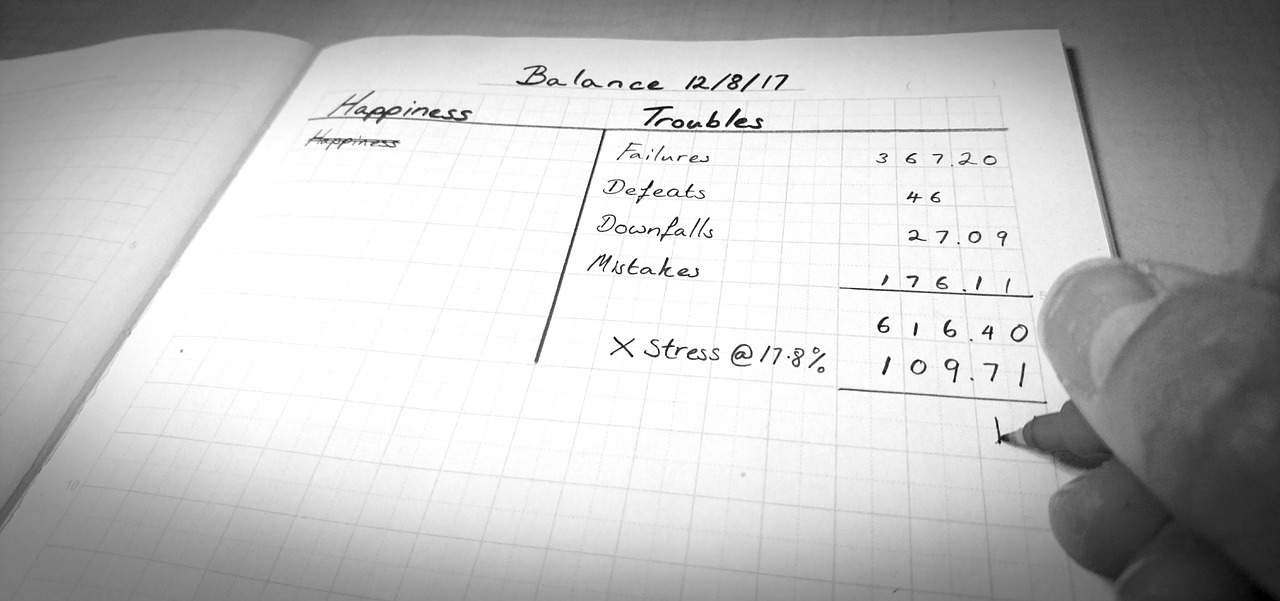

In the world of accounting, a trial balance is like a musical score—it ensures every note (or number) plays in tune before the final performance (financial statements). Whether you’re a small business owner, a budding bookkeeper, or just curious about keeping the books straight, learning to create a trial balance is a foundational skill.

It’s not just about checking math; it’s about confirming your financial story adds up. Let’s break it down into simple, actionable steps and explore why this process is your gateway to accounting clarity.

What Is a Trial Balance, Anyway?

A trial balance is a snapshot of all your accounts at a specific moment, listing their balances to verify that total debits equal total credits. It’s the accounting equivalent of a reality check—proof that your ledger is balanced and ready for the next step, like preparing an income statement or balance sheet. If the numbers don’t match, it’s a red flag that something’s off, like a misplaced transaction or a typo. Think of it as the gatekeeper between raw data and polished reports.

Why Bother with a Trial Balance?

Beyond satisfying accounting rules, a trial balance saves time and headaches. It catches errors early—before they snowball into misreported profits or tax troubles. For a small business, it might mean spotting that a $500 expense was recorded twice. For a larger firm, it could reveal a systemic glitch in payroll. Plus, it builds trust—whether for your own peace of mind or an auditor’s nod of approval.

Your Step-by-Step Guide to Making a Trial Balance

Ready to roll up your sleeves? Here’s how to create a trial balance from scratch, with a dash of creativity to keep it fun.

Gather Your Ledger Accounts

Start with your general ledger—the master record of all transactions. This includes every account: cash, revenue, expenses, accounts payable, equipment, and more. Picture it as your financial toolbox—every wrench and hammer (or dollar and cent) has a place.

List Each Account and Its Balance

Grab a sheet of paper, spreadsheet, or accounting software. Write down every account name in one column. Next to it, note its ending balance at your chosen date (say, month-end). For assets and expenses (debits), the balance is usually positive. For liabilities, equity, and revenue (credits), it’s also positive but lives on the other side of the equation. Don’t worry about negatives yet—just record what’s there.

Separate Debits and Credits

Create two more columns: one for debits, one for credits. For each account, place its balance in the appropriate column based on its nature. Cash with $1,000 goes under debits; a $500 loan stays in credits. If an account has no balance (zero), list it anyway—completeness matters.

Total the Columns

Add up all the debit balances in one grand sum. Do the same for the credits. This is the moment of truth—think of it like weighing two sides of a scale. If your accounting is spot-on, the debit total will equal the credit total. For example: $10,000 in debits (cash, supplies) should match $10,000 in credits (revenue, loans).

Troubleshoot Any Mismatch

If the totals don’t align—say, debits are $10,000 but credits are $9,800—don’t panic. Hunt for the culprit. Common culprits? A transaction entered on one side but not the other (a $200 sale missing its credit), a math error, or a transposed number ($540 recorded as $450). Recheck your ledger, line by line, until harmony is restored.

Present Your Trial Balance

Once balanced, tidy it up. List accounts in a logical order—assets, liabilities, equity, revenue, expenses—and label it with the date (e.g., “Trial Balance as of February 28, 2025”). You’ve got a clean, clear document ready for analysis or reporting.

A Sample to Spark Inspiration

Imagine a tiny coffee shop. Its ledger shows:

- Cash: $2,000 (debit)

- Supplies: $300 (debit)

- Revenue: $2,100 (credit)

- Loan: $200 (credit)

In the trial balance:

- Debits: $2,000 (Cash) + $300 (Supplies) = $2,300

- Credits: $2,100 (Revenue) + $200 (Loan) = $2,300

Balanced! The shop’s on solid ground.

Tips to Make It Easier

- Go Digital: Software like QuickBooks or Xero can auto-generate a trial balance, but understanding the manual process builds confidence.

- Double-Check Dates: Ensure all transactions up to your cutoff are included—no stragglers from next month.

- Keep It Regular: Monthly trial balances catch errors faster than waiting for year-end.

- Color-Code: In a spreadsheet, highlight debits in blue and credits in green for a visual cue.

Overcoming Trial Balance Hiccups

Numbers not matching? It’s frustrating but fixable. If the difference is divisible by 9 (e.g., $18), you might have swapped digits somewhere. If it’s a round number (e.g., $100), check for a missed entry. For tricky cases, trace each transaction back to its source—receipts, invoices, bank statements. Patience is your ally.

Beyond the Basics: The Bigger Picture

A trial balance isn’t the end—it’s a launchpad. Once balanced, it feeds into financial statements that tell your business’s story to investors, lenders, or yourself. It’s also a habit that sharpens your financial instincts over time. Spot a rising expense trend? Adjust before it bites.

Conclusion: Balance Today, Thrive Tomorrow

Creating a trial balance might sound like a chore, but it’s a superpower in disguise. It’s your assurance that every financial move—every sale, purchase, or payment—sings in sync. With a little practice, you’ll turn columns of numbers into a clear picture of where you stand and where you’re headed. So grab your ledger, tally those totals, and take control of your financial narrative—one balanced line at a time.

Frequently Asked Questions (FAQs)

1. What is a trial balance?

A trial balance is a summary of all your accounts, listing their balances at a specific time to ensure that total debits equal total credits.

2. Why is a trial balance important?

It helps identify errors in your accounting records before they lead to larger issues, ensuring financial accuracy and clarity.

3. How do I create a trial balance?

Gather your ledger accounts, list each account with its balance, separate debits and credits, total the columns, troubleshoot any mismatches, and present the final trial balance clearly.

4. What if my trial balance doesn’t balance?

Check for common mistakes, such as missing transactions, math errors, or transposed numbers. Review each entry in your ledger until you find the discrepancy.

5. How often should I prepare a trial balance?

It’s advisable to prepare it regularly, ideally monthly, to catch errors early and maintain accurate financial records.

6. Can software help with trial balances?

Yes, accounting software like QuickBooks or Xero can automate the process and generate a trial balance, but understanding the basics is essential for accuracy.

7. What are some tips for making trial balances easier?

Use digital tools, double-check transaction dates, keep it regular, and consider color-coding debits and credits for quick identification.