dasdasd

Category: Cost Accounting

Cost accounting is a branch of accounting that deals with the identification, measurement, analysis, and allocation of costs associated with producing goods or providing services. Its primary objective is to provide information to management for decision-making, cost control, and performance evaluation. Cost accounting helps businesses understand their costs and aids in determining the most efficient use of resources.

Key features and concepts of cost accounting include:

- Cost Classification: Costs stand classified into various categories based on their behavior, traceability, and relevance to decision-making. Common cost classifications include direct costs, indirect costs, variable costs, fixed costs, and semi-variable costs.

- Cost Elements: Cost elements represent the specific costs incurred in the production process. Such as raw materials, labor, overhead, and administrative expenses.

- Cost Allocation: This process involves distributing indirect costs to different cost centers or products using allocation bases, such as direct labor hours or machine hours.

- Cost Object: A cost object is anything to which costs can assign, such as a product, project, department, or customer.

- Costing Methods: Costing methods stand used to allocate costs to cost objects. Common costing methods include job costing, process costing, and activity-based costing (ABC).

- Standard Costing: Standard costing involves setting predetermined standard costs for materials, labor, and overhead. Actual costs are then compared to these standards to evaluate performance.

- Variance Analysis: Variance analysis is used to compare actual costs with standard costs, identifying discrepancies and investigating the reasons for the differences.

- Marginal Costing: Marginal costing focuses on the impact of variable costs on profit and decision-making, particularly in short-term scenarios.

- Cost-Volume-Profit (CVP) Analysis: CVP analysis helps determine the relationship between costs, sales volume, and profit. It assists in calculating the breakeven point and analyzing the impact of changes in sales or costs on profit.

Cost accounting is crucial for businesses as it provides insights into the cost structure, cost drivers, and profitability of products and services. It helps management make informed decisions to optimize resources, improve efficiency, and achieve cost reduction. While maintaining product quality and customer satisfaction. Additionally, cost accounting supports budgeting and performance evaluation processes, allowing businesses to monitor and control their financial performance effectively.

-

Activity Based Costing: Meaning, Features, and Advantages

What is ABC (activity based costing)? It is the collection of financial, operational, performance information tracing the significant activities of the firm to product costs in production management. In other words, the knowledge of find out estimates costs of production for product costs.

What does mean ABC (activity based costing)? Meaning, Definition, Features or characteristics, advantages, and disadvantages.

Activity-based costing (ABC) is a new term develop for finding out the cost. The basic feature of ABC is its focus on activities as the fundamental cost objects. It uses activities as the basis for calculating the costs of products and services. The Activity-Based Costing (ABC) is a costing system, which focuses on activities performed to produce products. ABC is the costing in which costs first trace to activities and then to products. This costing system assumes that activities are responsible for the incurrence of costs and create the demands for activities.

For example, an online learning firm prepares tax returns; suppose Udemy teaches online students. Fees charge to products based on individual product’s use of each activity. In the traditional absorption costing system, fees first trace not to activities but an organizational unit, such as a department or plant and then to products. It means under both, ABC and traditional absorption costing system the second and final stage consists of tracing fees to the course.

Activity Based Costing: Meaning, Features, and Advantages; Image from Pixabay. Definition of ABC (activity based costing):

What is the ABC (activity based costing) definition? The following ABC definitions below;

According to CIMA as;

“Cost attribution to cost units on the basis of the benefit received from indirect activities e.g. ordering, setting up, assuring quality.”

According to CAM-1 organization of Arlinton Texas as;

“The collection of financial and operational performance information tracing the significant activities of the firm to product Costs.”

It bases on the belief that in the production process various activities give rise to costs. Generally, Activity Based Costing (ABC) defines as an accounting technique that allows an organization to determine the actual cost associated with each product and service produced by the organization without regard to the organizational structure. Amongst various benefits associated with the ABC approach, one of the major ones is that it helps to define the activities of the organization in terms of value-adding activities.

Features or Highlights or Characteristics of ABC (activity based costing):

What are the ABC (activity based costing) features or highlights or characteristics? The following ABC features below;

- The simple traditional distinction made between fixed cost and variable cost is not enough to guide to provide quality information to design a cost system.

- It is a two-stage product costing method that first assigns costs to activities and then allocates them to products based on each product’s consumption of activities.

- They can use by any organization that wants a better understanding of the costs of the goods and services it provides, including manufacturing, service, and even non- profit organizations.

- The cost pools in the two-stage approach now accumulate activity-related costs.

- An activity is any discrete task that an organization undertakes to make or deliver a product or service.

- It bases on the concept that products consume activities and activities to consume resources.

- The more appropriate distinction between cost behavior patterns is scale related, scope related, decisions related, and time-related. In other words, cost behavior is all performance-related product costs.

- Cost drivers need to identify. A cost driver is a structural determinant of cost-related activity. The logic behind this is that cost drivers dictate the cost behavior pattern. In tracing overhead cost to the product, a cost behavior pattern must understand so that appropriate cost drivers could identify.

ABC cost method is activity-based cost management:

What is activity-based cost management? Cost management is an accounting method that calculates material costs, labor costs, management costs, financial costs, etc. according to certain standards by the current accounting system.

This management approach sometimes fails to reflect the direct link between the activities undertaken and costs. Also, the ABC cost method is equivalent to a filter. It readjusts the original cost method so that people can see the direct connection between the cost consumption and the work they engage in so that people can analyze which cost inputs are effective. Which cost inputs are invalid.

The ABC (activity based costing) cost method mainly focuses on the production and operation process, strengthens operation management, focuses on specific activities and corresponding costs, and strengthens activity-based cost management.

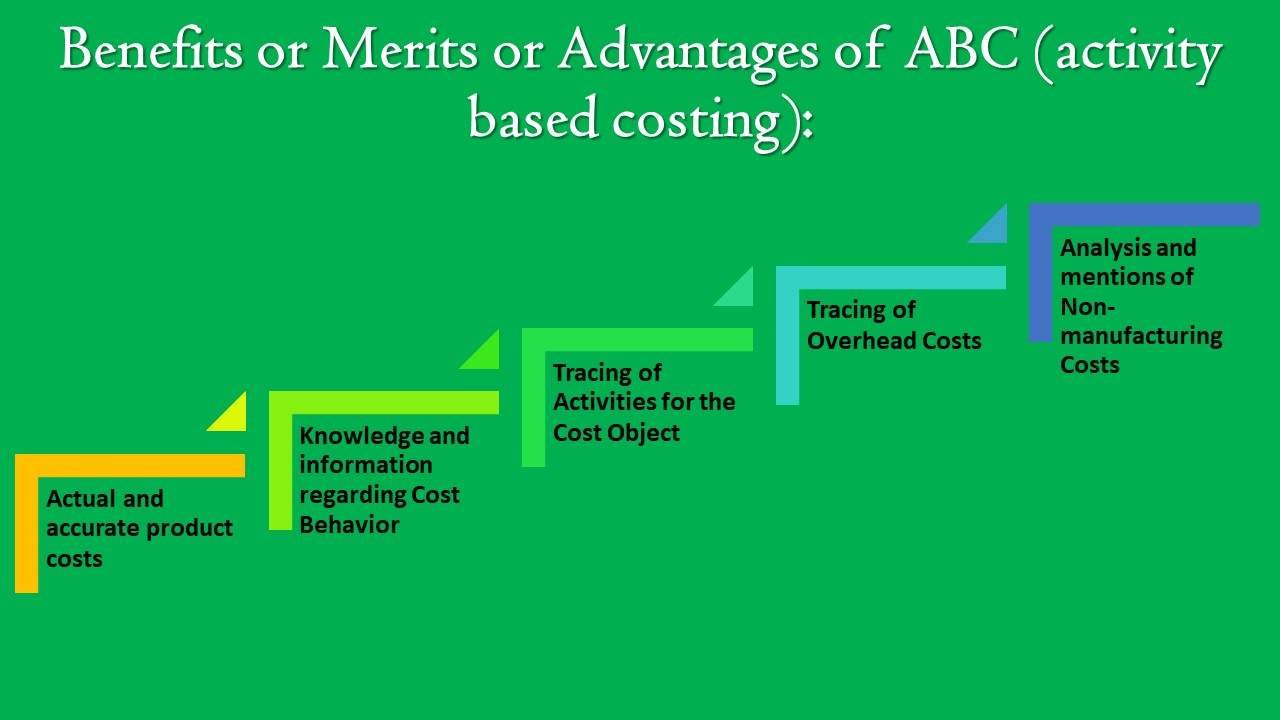

Benefits or Merits or Advantages of ABC (activity based costing):

What are the ABC (activity based costing) benefits or merits or advantages? The following ABC advantages below;

Actual and accurate product costs:

ABC brings actual, accuracy, and reliability in product costs determination by focusing on cause and effect relationships in the incurrence of the cost. It recognizes that it is activities which cause producing costs, not products and it is a product which consumes activities. In advanced manufacturing environment and technology where support functions over-heads constitute a large share of total or overall costs, ABC provides more realistic product costs. It produces reliable and correct product cost data in case of greater diversity among the products manufactured such as low-volume products, high-volume products.

Knowledge and information regarding Cost Behavior:

It identifies the real nature of cost behavior and helps in reducing costs and identifying activities that do not add value to the product, in other words producing costs. With ABC, managers can control many fixed overhead costs by exercising more control over the activities which have caused these fixed overhead costs. This is possible since the behavior of many fixed overhead costs about activities now becomes more visible and clear.

Tracing of Activities for the Cost Object:

ABC uses multiple cost drivers, many of which transaction-based rather than product volume. Further, ABC concern with all activities within and beyond the factory to trace more overheads to the products.

Tracing of Overhead Costs:

ABC traces costs to areas of managerial responsibility, processes, customers, departments besides the product costs. Costs tracing, accurate allocation of costs to various products lead to proper pricing policy. Also, Cost driver rates can use advantageously for the design of new products or existing products as they indicate overhead costs that are likely to apply in costing the product.

Analysis and mentions of Non-manufacturing Costs:

Some costs term as non-manufacturing costs; for example, product promotion or advertisement. Even though, advertising is a non-manufacturing cost which constitutes a major portion of the total cost of any product. These non-manufacturing costs can be easily allocated since the relationship between costs; and, their causes can properly understand by using ABC.

Limitations or Demerits or Disadvantages of ABC (activity based costing):

What are the ABC (activity based costing) limitations or demerits or disadvantages? The following ABC disadvantages below;

Service costs are High:

Implementing an ABC system requires substantial resources, which is costly to maintain.

Report or data collection problem:

It is a complex system which needs a lot of record for calculations.

Non-useable for small organizations:

In small organizations, the CEO or owner or managers accustom to using traditional costing systems to run their operations and traditional costing systems often use in performance evaluations. Some companies are producing only one product or a few products; so, the ABC cannot apply in there.

Activation or selection problem:

Some difficulties emerge in the implementation of the ABC system; such as the selection of cost drivers, assignment of common costs, varying cost driver rates, etc.

Different timeline of terms:

Since there are a lot of steps and groundwork required to come out with a costing based on this system, it is quite a time to consume. For example, large companies for the best costing system they produce the large size of production and give many products to us, but small or single handle company produces and give a single product. So, the large or multinational company collects many records and ABC work easy for long-term periods, as well as small organizations for difficult in short-term periods.

-

लागत लेखांकन के 10 उद्देश्य (Cost accounting objectives Hindi)

लागत लेखांकन लागत से इस अर्थ में भिन्न है कि पूर्व लागतों के निर्धारण के लिए केवल आधार और जानकारी प्रदान करता है। यह लेख लागत लेखांकन के 10 मुख्य उद्देश्य (Cost accounting objectives Hindi) की व्याख्या करता है। एक बार जानकारी उपलब्ध हो जाने के बाद, लागत को अंकगणितीय रूप से ज्ञापन कथनों का उपयोग करके या अभिन्न लेखांकन की विधि द्वारा किया जा सकता है।

यहां लागत लेखांकन के मुख्य उद्देश्य क्या हैं? विचार-विमर्श (Cost accounting objectives Hindi)

लागत लेखांकन का उद्देश्य खर्चों की व्यवस्थित रिकॉर्डिंग और एक संगठन द्वारा प्रदान की गई प्रत्येक उत्पाद की लागत का पता लगाने के लिए उसी का विश्लेषण करना है। प्रत्येक उत्पाद या सेवा की लागत के बारे में जानकारी प्रबंधन को यह जानने में सक्षम करेगी कि लागतों को कैसे कम किया जाए, कीमतों को कैसे तय किया जाए, मुनाफे को कैसे बढ़ाया जाए आदि।

लागत लेखांकन के 10 उद्देश्य (Cost accounting objectives Hindi):

इस प्रकार, लागत लेखांकन की मुख्य वस्तुएं निम्नलिखित हैं:

- उत्पादों और परिचालनों की लागत से संबंधित सभी खर्चों का विश्लेषण और वर्गीकरण करना।

- हर इकाई, नौकरी, संचालन, प्रक्रिया, विभाग या सेवा के उत्पादन की लागत पर पहुंचने और लागत मानक विकसित करने के लिए।

- किसी भी अक्षमता और कचरे के विभिन्न रूपों की सीमा, सामग्री, समय, खर्च या मशीनरी, उपकरण और उपकरणों के उपयोग में प्रबंधन को इंगित करने के लिए। असंतोषजनक परिणामों के कारणों का विश्लेषण उपचारात्मक उपायों का संकेत दे सकता है।

- इस तरह के अंतराल पर आवधिक लाभ और हानि खातों और बैलेंस शीट के लिए डेटा प्रदान करने के लिए, जैसे, साप्ताहिक, मासिक या त्रैमासिक, जैसा कि वित्तीय वर्ष के दौरान प्रबंधन द्वारा वांछित हो सकता है, न केवल पूरे व्यवसाय के लिए बल्कि विभागों या व्यक्तिगत उत्पादों द्वारा भी। इसके अलावा, लाभ और हानि के सटीक कारणों के बारे में विस्तार से समझाने के लिए, लाभ और हानि खाते में।

- उत्पादन के तरीकों, उपकरण, डिजाइन, आउटपुट और लेआउट के संबंध में अर्थव्यवस्थाओं के स्रोतों को प्रकट करना। त्वरित और रचनात्मक कार्रवाई सुनिश्चित करने के लिए दैनिक, साप्ताहिक, मासिक या त्रैमासिक जानकारी आवश्यक हो सकती है।

जारी रखें:

लागत लेखांकन के 10 उद्देश्य (Cost accounting objectives Hindi) - अनुमानों की तुलना के लिए लागत के वास्तविक आंकड़े प्रदान करना और भविष्य के अनुमानों या उद्धरणों के लिए एक मार्गदर्शक के रूप में सेवा करना और उनकी मूल्य निर्धारण नीति में प्रबंधन की सहायता करना।

- यह दिखाने के लिए, कि मानक लागत कहाँ तैयार की जाती है, उत्पादन की लागत क्या होनी चाहिए और जिसके साथ वास्तविक लागत जो अंततः दर्ज की जाती है, की तुलना की जा सकती है।

- विभिन्न अवधियों और आउटपुट के विभिन्न संस्करणों के लिए तुलनात्मक लागत डेटा प्रस्तुत करना।

- दुकानों और अन्य सामग्रियों की एक सतत सूची प्रदान करने के लिए ताकि स्टॉक-टेक के बिना अंतरिम लाभ और हानि खाता और बैलेंस शीट तैयार की जा सके और दुकानों और समायोजन पर लगातार अंतराल पर जांच की जाती है। उत्पादन योजना के लिए और अनावश्यक अपव्यय या सामग्री और दुकानों के नुकसान से बचने के लिए आधार प्रदान करने के लिए भी।

- विभिन्न प्रकार के अल्पकालिक निर्णय लेने के लिए प्रबंधन को सक्षम करने के लिए जानकारी प्रदान करने के लिए, जैसे कि विशेष ग्राहकों के लिए मूल्य का उद्धरण या मंदी के दौरान, निर्णय लेना या खरीदना, विभिन्न उत्पादों को प्राथमिकता देना, आदि।

-

लागत लेखांकन के सिद्धांत (Cost accounting principles Hindi)

लागत लेखांकन (Cost accounting) उत्पादों या सेवाओं की लागत के निर्धारण के लिए व्यय का वर्गीकरण, रिकॉर्डिंग और उचित आवंटन है, और प्रबंधन और नियंत्रण के मार्गदर्शन के लिए उपयुक्त रूप से व्यवस्थित डेटा की प्रस्तुति है। यह लेख उनके अर्थ और परिभाषा के साथ लागत लेखांकन के सिद्धांत (Cost accounting principles Hindi) की व्याख्या करता है। इसमें हर आदेश, नौकरी, अनुबंध, प्रक्रिया, सेवा या इकाई की लागत का पता लगाना उचित हो सकता है। यह उत्पादन, बिक्री और वितरण की लागत से संबंधित है।

लागत लेखांकन के अर्थ, परिभाषा और सिद्धांत (Cost accounting meaning definition principles Hindi):

व्हील्डन के अनुसार, “लागत लेखांकन लेखांकन और लागत के सिद्धांतों, विधियों और तकनीकों में लागतों की पहचान और पिछले अनुभव के साथ या मानकों के साथ तुलना में बचत / या अतिरिक्त लागत के विश्लेषण का अनुप्रयोग है”।

लागत लेखांकन के सिद्धांत (Cost accounting principles Hindi):

निम्नलिखित लागत लेखांकन के सामान्य सिद्धांतों के रूप में माना जा सकता है;

लागत लेखांकन के सिद्धांत (Cost accounting principles Hindi) Indian Rupees #Pixabay एक लागत इसके कारण से संबंधित होनी चाहिए:

लागत को उनके कारणों से यथासंभव संबंधित होना चाहिए ताकि लागत केवल उस विभाग के माध्यम से गुजरने वाली लागत इकाइयों के बीच साझा की जा सके, जिसके लिए खर्चों पर विचार किया जा रहा है।

लागत लगने के बाद ही शुल्क लिया जाना चाहिए:

व्यक्तिगत इकाइयों की लागत का निर्धारण करते समय जिन लागतों पर खर्च किया गया है, उन पर विचार किया जाना चाहिए; उदाहरण के लिए, एक लागत इकाई को बेचने की लागत का शुल्क नहीं लिया जाना चाहिए; जबकि यह अभी भी कारखाने में है; जबकि विक्रय लागत उन उत्पादों के साथ ली जा सकती है, जो बेचे जाते हैं।

विवेक की परंपरा को नजरअंदाज किया जाना चाहिए:

आमतौर पर, लेखाकार ऐतिहासिक लागतों पर विश्वास करता है और लागत का निर्धारण करते समय; वे हमेशा ऐतिहासिक लागत को महत्व देते हैं; लागत लेखांकन में इस सम्मेलन को अनदेखा किया जाना चाहिए, अन्यथा, परियोजनाओं की लाभप्रदता के प्रबंधन मूल्यांकन को समाप्त किया जा सकता है; एक लागत विवरण, जहां तक संभव हो, तथ्यों को बिना किसी पूर्वाग्रह के देना चाहिए; यदि किसी आकस्मिकता को ध्यान में रखा जाना चाहिए तो उसे अलग और स्पष्ट रूप से दिखाया जाना चाहिए।

असामान्य लागत को लागत खातों से बाहर रखा जाना चाहिए:

लागत जो असामान्य हैं (जैसे दुर्घटना, लापरवाही, आदि) लागत की गणना करते समय उपेक्षा की जानी चाहिए; अन्यथा, यह लागत के आंकड़ों को विकृत कर देगा और सामान्य परिस्थितियों में उनके उपक्रम के कार्य परिणामों के रूप में प्रबंधन को भ्रमित करेगा।

भविष्य की अवधि के लिए शुल्क नहीं चुकाने की विगत लागत:

संबंधित अवधि के दौरान लागत जो पूरी तरह से वसूल नहीं की जा सकती है या वसूल नहीं की जा सकती है; उसे भविष्य में वसूली के लिए नहीं लिया जाना चाहिए; यदि भविष्य की अवधि में पिछली लागतों को शामिल किया जाता है; तो वे भविष्य की अवधि को प्रभावित करने की संभावना रखते हैं; और, भविष्य के परिणाम विकृत होने की संभावना है।

जहाँ आवश्यक हो, डबल-एंट्री के सिद्धांतों को लागू किया जाना चाहिए:

लागत निर्धारण और लागत नियंत्रण के लिए लागत शीट्स और लागत विवरणों के अधिक उपयोग की आवश्यकता होती है; लेकिन लागत बहीखाता और लागत नियंत्रण खातों को यथासंभव दोहरे प्रविष्टि सिद्धांत पर रखा जाना चाहिए।

-

Process Costing: Meaning, Characteristics, and Objectives

Process Costing is a method of costing used to ascertain the cost of a product at each process or stage of manufacture. You will be able to understand the Process Costing based on the points given to them; 1) introduction, 2) meaning of process costing, 3) definition of process costing, 4) characteristics of process costing, 5) objectives of process costing, and 6) principles of process costing. In this method, the costs of materials, wages and overheads are accumulated for each process separately, for a gives period, and then carrying forward cumulatively from one process to the next process till the last process complete.

This article explains the topic of Process Costing: Introduction, Meaning, Definition, Characteristics, Objectives, and Principles.

Process costing is probably the most widely used method of cost ascertainment. Records are also maintaining to account for process losses. These losses may be normal or abnormal. Separate accounting is done for normal and abnormal losses, opening and closing work-in-progress and inter-process profits, if any. This method of costing used in those industries where mass production of identical units undertakes continuously and finish products are subject to several production stages call processes before completion.

The system of process costing is suitable for industries involving continuous production of the same product or products through the same process or set of processes. It is in use in the plant producing paper, rubber products, medicines, chemical products. It is also very much common in flour mill, bottling companies, canning plants, breweries, etc.

Meaning of Process Costing:

They refer to a method of accumulating the cost of production by the process. It uses in mass production industries producing standard products like steel, sugar, chemicals, oil, etc. In all such industries, goods produced are identical and all factory processes are standardizing. Output in such industries consists of like units and every unit of the product undergoes a similar operation in the process.

So it implies that the same cost of material, labor and overhead charges to each unit of the production process. Under this method, costing an individual unit is impossible. It so-calls because under process costing cost of the product ascertain process-wise.

They also know as “Continuous Costing” because industries that adopt process costing undertake the production of goods continuously. They also know as “Average Costing” because the cost per unit of each process ascertains by averaging the expenditure incurred on that process during a period by the number of units produced in that process during the period.

Definition of Process Costing:

After their meaning, Process Costing defines by different scholars as under:

According to Wheldon,

“Process costing is a method of costing used to ascertain the cost of the product at each process, operation or stage of manufacture.”

According to the Institute of Cost and Management Accountants, London,

“Process costing is that form of operation costing which applies where standardized goods are produced.”

Characteristics or Features of Process Costing:

It is that aspect of operation costing which uses to ascertain the cost of the product at each process or stage of manufacture. Where processes are carrying on having one or more of the following characteristics of Process costing:

- Production over having a continuous flow of identical products except. Where plant and machinery are shut-down for repairs, etc.

- Clearly defined process cost centers and the accumulation of all costs (materials, labor, and overheads) by the cost centers.

- The maintenance of accurate records of units and part units produced and cost incurred by each process.

- The finished product of one process becomes the raw materials of the next process or operation and so on until the final product obtains.

- Avoidable and unavoidable losses usually arise at different stages of manufacture for various reasons. Treatment of normal and abnormal losses or gains is to study in this method of costing.

Extra characteristics:

- Sometimes goods are transferring from one process to another process, not at cost price but transfer price just to compare this with the market price and to have a check on the inefficiency and losses occurring in a particular process. The elimination of the profit elements from stock is to learn in this method of costing.

- To obtain accurate average costs, it is necessary to measure the production at various stages of manufacture. As all the input units may not convert into finish goods; some may be in progress. The calculation of effective units is to learn in this method of costing.

- Different products with or without by-products are simultaneously producing at one or more stages or processes of manufacture. The valuation of by-products and apportionment of the joint cost before the point of separation is an important aspect of this method of costing. In certain industries, by-products may require further processing before they can sell.

- The main product of one firm may be a by-product of another firm and in certain circumstances. It may be available in the market at prices which are lower than the cost to the first-mentioned firm. It is essential, therefore, that this cost knows so that advantages can take of these market conditions.

- The output is uniform and all units are identical during one or more processes. So the cost per unit of production can ascertain only by averaging the expenditure incurred during a particular period.

Process Costing: Meaning, Characteristics, and Objectives, #Pixabay. Objectives of Process Costing:

How do you know what cost you need? If you know the total cost of production of each process. The following are the main objectives of process costing:

- To Ascertain the Cost of Each Process: It is necessary to know the cost at every stage of production and this fulfills by the process costing method. On this basis, management can decide concerning the make or buy the required commodities.

- To Ascertain the Cost of Bye-Product: Bye-product is that which obtains with the main product in the course of the production. For example; while producing mustard oil, the cake also obtains. Which terms as bye-product and the cost of which is necessary to know the actual cost of the main product? Cost of bye-product ascertains by preparing bye-product Account, under process costing.

- To Know the Wastage in Each Process of Production: During the courage of production, different wastages, such as; loss in weight, normal wastage, and abnormal wastage, etc. may arise. Management of any concern may know about these wastages by Process Costing Account.

- To Ascertain the Profit or Loss of Each Process: The output or the part of output at the stage of every process can sell out either at profit or loss. Thus the management can know about the profit or loss at every process by preparing Processes Account.

- The base of the Valuation of Opening and Closing Stock of Each Next Process: If the total cost of production of any process divides by the number of units, we get the cost of production per unit of that particular process and on this basis opening and closing stock of next process value.

Principles of Process Costing:

The essential stages in principles of process costing are:

The factory divide into several processes and an account maintains for each process. Each Process Account debit with material cost, labor cost, direct expenses, and overheads allocate or apportion to the process.

The output of a process transfer to the next process in the sequence. In other words, the finished output of one process becomes input (materials) of the next process. The production records of each process are keeping in such a way as to show. The quantity of production and the wastage and scrap and the cost of production of each process for each period.

Extra things:

- In some cases, the whole output of one process not transfers to the next process. A part of the output may transfer to the next process. And, a certain portion of the output may sell in semi-finish form or may keep in stock and transfer to Process Stock Account. If the output of any process sells at a profit in semi-finish form. Then profit on that particular sale will show on the debit side of that concerning profit, as profit on goods sale or transfer.

- In case there is loss or wastage of units in any process. The loss has to born by the good units produced in that process and as a result. The average cost per unit increases to that extent. It may note that, if there is loss or wastage in any process, the quantity of loss or wastage should enter on the credit side of the concerned Process Account in the quantity column. In case the wastage has some scrap value. It should appear on the credit side of the concerned Process Account in the value column against the entry for wastage. But, if the scrap value of the wastage does not specifically give in the problem. It should take as nil.

The total cost of production of each process for a particular period divided by the number of units produced in that process during that period. And, the average cost per unit of production for a period obtain. The finished output of the last process transfer to the Finish Goods Account.

-

प्रक्रिया लागत: अर्थ, विशेषताएँ और उद्देश्य (Process Costing Hindi)

प्रक्रिया लागत (Process Costing), लागत की एक विधि है जिसका उपयोग प्रत्येक प्रक्रिया या निर्माण के चरण में उत्पाद की लागत का पता लगाने के लिए किया जाता है। आप उन्हें दिए गए बिंदुओं के आधार पर प्रक्रिया लागत को समझने में सक्षम होंगे; परिचय, प्रक्रिया लागत का अर्थ, प्रक्रिया लागत की परिभाषा, प्रक्रिया लागत की विशेषताएँ, प्रक्रिया लागत के उद्देश्य और प्रक्रिया लागत के सिद्धांत। इस विधि में, सामग्री, मजदूरी और ओवरहेड्स की लागत प्रत्येक प्रक्रिया के लिए अलग-अलग अवधि के लिए जमा होती है, और फिर अंतिम प्रक्रिया पूरी होने तक एक प्रक्रिया से अगली प्रक्रिया तक संचयी रूप से आगे ले जाती है।

यह आलेख प्रक्रिया लागत के विषय की व्याख्या करता है: परिचय, अर्थ, परिभाषा, विशेषताएँ, उद्देश्य और सिद्धांत।

यह संभवतया लागत निर्धारण का सबसे व्यापक रूप से उपयोग किया जाने वाला तरीका है। प्रक्रिया के नुकसान के लिए रिकॉर्ड भी बनाए हुए हैं। ये नुकसान सामान्य या असामान्य हो सकते हैं। सामान्य और असामान्य नुकसान के लिए अलग-अलग लेखांकन किया जाता है, काम और प्रगति और अंतर-प्रक्रिया मुनाफे को खोलना और बंद करना, यदि कोई हो। लागत का यह तरीका उन उद्योगों में उपयोग किया जाता है जहां समान इकाइयों का बड़े पैमाने पर उत्पादन निरंतर होता है और उत्पाद खत्म होने से पहले कई उत्पादन चरणों कॉल प्रक्रियाओं के अधीन होते हैं।

प्रक्रिया लागत की प्रणाली एक ही उत्पाद या उत्पादों के निरंतर उत्पादन को शामिल करने वाले उद्योगों के लिए उपयुक्त है या प्रक्रियाओं के सेट के माध्यम से। यह कागज, रबर उत्पादों, दवाओं, रासायनिक उत्पादों के उत्पादन में उपयोग में है। यह आटा चक्की, बॉटलिंग कंपनियों, कैनिंग प्लांट, ब्रुअरीज, आदि में भी बहुत आम है।

प्रक्रिया लागत का अर्थ:

वे प्रक्रिया द्वारा production cost को जमा करने की एक विधि का उल्लेख करते हैं। यह इस्पात, चीनी, रसायन, तेल आदि जैसे मानक उत्पादों का उत्पादन करने वाले बड़े पैमाने पर उत्पादन उद्योगों में उपयोग करता है। ऐसे सभी उद्योगों में उत्पादित माल समान हैं और सभी कारखाने प्रक्रियाएं मानकीकृत हैं। ऐसे उद्योगों में Output इकाइयों की तरह होते हैं और उत्पाद की प्रत्येक इकाई प्रक्रिया में एक समान संचालन से गुजरती है।

तो इसका तात्पर्य है कि उत्पादन प्रक्रिया की प्रत्येक इकाई को सामग्री, श्रम और उपरि शुल्क की समान लागत। इस पद्धति के तहत, एक व्यक्ति इकाई की लागत असंभव है। यह इसलिए कॉल करता है क्योंकि प्रक्रिया के तहत उत्पाद की लागत का पता लगाने की प्रक्रिया-वार होती है।

उन्हें “निरंतर लागत” के रूप में भी जाना जाता है क्योंकि जो उद्योग प्रक्रिया लागत को अपनाते हैं वे लगातार माल का उत्पादन करते हैं। उन्हें “औसत लागत” के रूप में भी जाना जाता है क्योंकि प्रत्येक प्रक्रिया की लागत उस प्रक्रिया पर किए गए व्यय के औसत द्वारा उस अवधि के दौरान उस प्रक्रिया में उत्पादित इकाइयों की संख्या से औसतन पता लगाती है।

प्रक्रिया लागत की परिभाषा:

उनके अर्थ के बाद, अलग-अलग विद्वानों द्वारा प्रक्रिया लागत को निम्नानुसार परिभाषित किया गया है:

Wheldon के अनुसार,

“प्रक्रिया लागत, लागत की एक विधि है, जिसका उपयोग प्रोडक्ट की प्रत्येक प्रक्रिया, संचालन या निर्माण के चरण में लागत का पता लगाने के लिए किया जाता है।”

इंस्टीट्यूट ऑफ कॉस्ट एंड मैनेजमेंट अकाउंटेंट्स, लंदन के अनुसार,

“प्रक्रिया लागत, ऑपरेशन लागत का वह रूप है जो लागू होता है जहाँ मानकीकृत सामान का उत्पादन किया जाता है।”

प्रक्रिया लागत के लक्षण या विशेषताएँ:

यह Operation cost का वह पहलू है जो निर्माण की प्रत्येक प्रक्रिया या चरण में Product cost का पता लगाने के लिए उपयोग करता है। प्रक्रिया लागत के निम्नलिखित विशेषताएँ में से एक या अधिक होने पर प्रक्रियाएं कहां चल रही हैं:

- सिवाय समान उत्पादों के एक निरंतर प्रवाह होने पर उत्पादन। जहां संयंत्र और मशीनरी मरम्मत के लिए बंद हैं, आदि।

- लागत केंद्रों द्वारा स्पष्ट रूप से परिभाषित प्रक्रिया लागत केंद्र और सभी लागतों (सामग्री, श्रम और ओवरहेड्स) का संचय।

- प्रत्येक प्रक्रिया द्वारा उत्पादित और लागत वाली इकाइयों और भाग इकाइयों के सटीक रिकॉर्ड का रखरखाव।

- एक प्रक्रिया का तैयार उत्पाद अगली प्रक्रिया या संचालन का कच्चा माल बन जाता है और अंतिम उत्पाद प्राप्त होने तक।

- परिहार्य और अपरिहार्य नुकसान आमतौर पर विभिन्न कारणों से निर्माण के विभिन्न चरणों में उत्पन्न होते हैं। सामान्य और असामान्य नुकसान या लाभ का उपचार लागत की इस पद्धति में अध्ययन करना है।

अतिरिक्त विशेषताएँ:

- कभी-कभी माल एक प्रक्रिया से दूसरी प्रक्रिया में स्थानांतरित हो रहा है, cost price पर नहीं, बल्कि मूल्य को बाजार मूल्य के साथ तुलना करने के लिए और एक विशेष प्रक्रिया में होने वाली अक्षमता और नुकसान की जांच करना है। स्टॉक से लाभ तत्व का Elimination cost की इस पद्धति में सीखना है।

- सटीक औसत लागत प्राप्त करने के लिए, उत्पादन के विभिन्न चरणों में उत्पादन को मापना आवश्यक है। के रूप में सभी इनपुट इकाइयों खत्म माल में परिवर्तित नहीं हो सकता है; कुछ प्रगति पर हो सकता है। प्रभावी इकाइयों की गणना लागत की इस पद्धति में सीखना है।

- उप-उत्पादों के साथ या बिना विभिन्न उत्पाद एक साथ एक या अधिक चरणों या निर्माण की प्रक्रियाओं पर उत्पादन कर रहे हैं। जुदाई के बिंदु से पहले संयुक्त लागत के उप-उत्पादों और मूल्यांकन का मूल्यांकन लागत की इस पद्धति का एक महत्वपूर्ण पहलू है। कुछ उद्योगों में, उत्पादों को बेचने से पहले और प्रसंस्करण की आवश्यकता हो सकती है।

- एक फर्म का मुख्य उत्पाद किसी अन्य फर्म का उप-उत्पाद और कुछ परिस्थितियों में हो सकता है। यह बाजार में उन कीमतों पर उपलब्ध हो सकता है जो पहले उल्लेखित फर्म की लागत से कम है। इसलिए, यह आवश्यक है कि यह लागत पता हो ताकि लाभ इन बाजार स्थितियों का लाभ उठा सकें।

- Output एक समान है और सभी इकाइयां एक या अधिक प्रक्रियाओं के दौरान समान हैं। तो उत्पादन की प्रति यूनिट लागत एक विशेष अवधि के दौरान किए गए व्यय के औसत से ही पता लगा सकती है।

प्रक्रिया लागत: अर्थ, विशेषताएँ और उद्देश्य (Process Costing Hindi) #Pixabay. प्रक्रिया लागत के उद्देश्य:

आप कैसे जानते हैं कि आपको किस cost की आवश्यकता है? यदि आप प्रत्येक प्रक्रिया के उत्पादन की total cost जानते हैं। प्रक्रिया लागत के मुख्य उद्देश्य निम्नलिखित हैं:

- प्रत्येक प्रक्रिया की लागत का पता लगाने के लिए: उत्पादन के प्रत्येक चरण में लागत जानना आवश्यक है और यह Process Costing Metods द्वारा पूरी होती है। इस आधार पर, प्रबंधन आवश्यक वस्तुओं को बनाने या खरीदने के संबंध में निर्णय ले सकता है।

- उप-उत्पाद की लागत का पता लगाने के लिए: उप-उत्पाद वह है जो उत्पादन के दौरान मुख्य उत्पाद के साथ प्राप्त करता है। उदाहरण के लिए; सरसों के तेल का उत्पादन करते समय, केक भी प्राप्त करता है। मुख्य उत्पाद की वास्तविक लागत को जानने के लिए कौन से शब्द उप-उत्पाद और किसकी लागत आवश्यक है? Process Costing के तहत उप-उत्पाद खाता तैयार करके उप-उत्पाद की लागत का पता लगाया जाता है।

- उत्पादन की प्रत्येक प्रक्रिया में अपव्यय जानने के लिए: उत्पादन के साहस के दौरान, विभिन्न अपव्यय, जैसे; वजन में कमी, सामान्य अपव्यय और असामान्य अपव्यय आदि उत्पन्न हो सकते हैं। किसी भी चिंता के प्रबंधन को Process Costing खाते द्वारा इन अपव्ययों के बारे में पता चल सकता है।

- प्रत्येक प्रक्रिया के लाभ या हानि का पता लगाने के लिए: हर प्रक्रिया के चरण में Output या Output का हिस्सा लाभ या हानि पर बेच सकता है। इस प्रकार प्रबंधन प्रॉसेस खाता तैयार करके हर प्रक्रिया में लाभ या हानि के बारे में जान सकता है।

- प्रत्येक अगली प्रक्रिया के उद्घाटन और समापन स्टॉक की वैल्यूएशन का आधार: यदि किसी भी प्रक्रिया के उत्पादन की total cost इकाइयों की संख्या से विभाजित होती है, तो हमें उस विशेष प्रक्रिया के प्रति यूनिट Cost of production मिलती है और इस आधार पर स्टॉक को खोलना और बंद करना अगले प्रक्रिया मूल्य के लिए।

प्रक्रिया लागत के सिद्धांत:

प्रक्रिया लागत के सिद्धांतों में आवश्यक चरण हैं:

कारखाना कई प्रक्रियाओं में विभाजित होता है और प्रत्येक प्रक्रिया के लिए एक खाता होता है। प्रत्येक प्रक्रिया खाता Debit Material cost, labor cost, प्रत्यक्ष व्यय, और ओवरहेड्स प्रक्रिया को आवंटित या आशंकित करती है।

एक प्रक्रिया का Outputअनुक्रम में अगली प्रक्रिया में स्थानांतरित होता है। दूसरे शब्दों में, एक प्रक्रिया का तैयार Output अगली प्रक्रिया का इनपुट (सामग्री) बन जाता है। प्रत्येक प्रक्रिया के उत्पादन रिकॉर्ड इस तरह से रख रहे हैं जैसे कि दिखाना है। उत्पादन की मात्रा और अपव्यय और स्क्रैप और प्रत्येक अवधि के लिए प्रत्येक प्रक्रिया के production cost।

अतिरिक्त चीजें:

- कुछ मामलों में, एक प्रक्रिया का पूरा Output अगली प्रक्रिया में स्थानांतरित नहीं होता है। Output का एक हिस्सा अगली प्रक्रिया में स्थानांतरित हो सकता है। और, Output का एक निश्चित हिस्सा अर्ध-फिनिश रूप में बेच सकता है या स्टॉक में रख सकता है और प्रक्रिया स्टॉक अकाउंट में ट्रांसफर कर सकता है। यदि किसी प्रक्रिया का Output अर्द्ध-फिनिश रूप में लाभ पर बेचता है। फिर उस विशेष बिक्री पर लाभ उस संबंधित लाभ के डेबिट पक्ष पर दिखाई देगा, जैसे कि माल की बिक्री या हस्तांतरण पर लाभ।

- मामले में किसी भी प्रक्रिया में इकाइयों का नुकसान या अपव्यय होता है। नुकसान का जन्म उस प्रक्रिया में उत्पन्न अच्छी इकाइयों द्वारा होता है और परिणामस्वरूप। प्रति यूनिट average cost उस सीमा तक बढ़ जाती है। यह ध्यान दें कि, यदि किसी प्रक्रिया में नुकसान या अपव्यय होता है, तो हानि या अपव्यय की मात्रा संबंधित कॉलम में संबंधित प्रक्रिया खाते के क्रेडिट पक्ष में दर्ज होनी चाहिए। मामले में अपव्यय का कुछ मूल्य है। यह अपव्यय के लिए प्रविष्टि के खिलाफ मूल्य स्तंभ में संबंधित प्रक्रिया खाते के क्रेडिट पक्ष में दिखाई देना चाहिए। लेकिन, अगर अपव्यय का स्क्रैप मूल्य विशेष रूप से समस्या में नहीं देता है। इसे शून्य के रूप में लेना चाहिए।

उस अवधि में उस प्रक्रिया में उत्पादित इकाइयों की संख्या से विभाजित एक विशेष अवधि के लिए प्रत्येक प्रक्रिया के उत्पादन की total cost। और, एक अवधि प्राप्त करने के लिए उत्पादन की प्रति यूनिट average cost। समाप्त माल खाते में अंतिम प्रक्रिया हस्तांतरण का तैयार Output।

-

Single Costing: Meaning, Characteristics, and Objectives

The single Costing method of the ascertainment of the cost of production is suitable for those industries in which manufacturing is continuous and units of output are identical. You will be able to understand the Single Costing based on the points given to them; introduction, the meaning of single costing, the definition of single costing, characteristics of single costing, and objectives of single costing. One operation costing method of costing by units of production and adopts where production is uniform and a continuous affair, units of output are identical and the cost units are physical and natural.

This article explains the topic of Single Costing: Introduction, Meaning, Definition, Characteristics, and Objectives.

The cost per single determines by dividing the total cost during a given period by the number of units produced during that period. This method of costing generally adopt where an undertaking engages in producing only one type of product or two or more products of the same kind but of varying grades or quality. The industries where this method of costing uses are the dairy industry, beverages, collieries, sugar mills, cement works, brick-works, paper mills, etc.

Meaning of Single Costing:

Single or Unit or Output costing is the method of costing in which cost is ascertained per unit of a single product in continuous manufacturing activity. Every Single or per unit, the cost calculates by dividing total production cost by several units produced.

This method knows as “Single costing” as industries adopting this method manufacture, in most cases, a single variety of products. This method also knows as “Unit costing”, as not only the cost of the total output but also the cost per unit of output ascertains under this method. Under this method cost units are identical. This method also calls “Output costing”, as the cost ascertains for the total output of a product.

Definition of Single Costing:

The following definitions below are;

According to J.R. Batliboi,

“Single or output cost system is used in businesses where a standard product is turned out and it is desired to find out the cost of a basic unit of production.”

The Institute of Cost and Management Accountants, London,

“output costing is the basic costing method applicable where goods or services result from a series of continuous or repetitive operations or processes to which costs are charged before being averaged over the units produced during the period.”

From the above definitions, it is clear that this costing is a method of costing under. Which there is the costing of a single product, which produces by continuous manufacturing activity. Though under this method of costing a single variety of product manufacturers. It may vary concerning size, grade, color, etc. The example of industries that make use of this method of costing is; brick, sugar, cloth, coal, cement, fisheries, food canning, quarries, plantation industries, etc.

Thus single costing adopts for cost ascertainment in those manufacturing organizations. Which is engaging in producing only one type of product or two or more products of the same kind but of varying grades or qualities? This method uses in industries like mines, quarries, oil drilling; breweries, cement works, brick-works, .sugar mills, steel manufacture and aluminum products, etc.

In all those industries where single costing uses, there is a standard or natural unit of cost. For example, a tonne of coal in collieries, one thousand bricks in brick-works, a quintal of sugar in the sugar industry, a tonne of cement in the cement industry, etc. In this costing, the cost of production usually ascertains by preparing a cost sheet or a cost statement.

Single Costing: Meaning, Characteristics, and Objectives, #Pixabay. Characteristic or Features of Industries Which Use Single Costing:

The following are the characteristics or features of the industries where the single costing method uses:

- The cost per unit of output, determined under a single. Costing enables the management to make a real comparison between different periods and between different firms within the same industry, as the unit of output is a common factor between different periods and between different firms within the same industry.

- Equality of cost is an important feature of this method. That is, under this method, identical cost units will have identical costs.

- Production is on a large scale and is continuous.

- The units of production are identical and homogeneous.

- One cost is the method of costing adopt in concerns where there is a production of a product. Or, a few grades of the same product differing only in size, shape or quality by the continuous process of manufacture. The units of production or output are identical and the costs of units are physical and natural.

- The cost units are physical and natural and capable of being expressed in a convenient unit of measurement.

- This method is the simplest method of all the methods of cost; in the sense that the cost collection and the cost ascertainment are quite simple.

- In most cases, the unit of measure is also the cost unit, viz., one unit (in the case of T.V., radio, camera), 1,000 units (in the case of bricks), one gross (in the case of pencils, slates, bolts, and nuts), one liter (in the case of paints), one tonne (in the case of coal, cement, and steel), one bale (in the case of cotton), etc.

Objectives of Single Costing:

Single costing is a very simple method of costing. Its principal objectives are as follows;

- To ascertain the per-unit cost of production by dividing the total cost of production by the number of units produced.

- To estimate per unit cost of production for the future and facilitate production planning.

- Help in the preparation of tenders and fixation of selling prices.

- To facilitate a comparison of the cost of production of two accounting periods.

- To control the cost of the product through the comparative study of the costs of any two periods. Or, the comparison of the actual costs with the Pre-determined standard cost.

- The analyze the expenditure by nature, classify them into the element of cost and know. The extent to which each element of cost contributes to the total cost.

- To ascertain the profit or loss of production.

-

एकल लागत: अर्थ, विशेषताएँ और उद्देश्य (Single Costing Hindi)

उत्पादन की लागत का पता लगाने की एकल लागत (Single Costing) विधि उन उद्योगों के लिए उपयुक्त है जिनमें विनिर्माण निरंतर है और उत्पादन की इकाइयाँ समान हैं । आप उन्हें दिए गए बिंदुओं के आधार पर एकल लागत को समझने में सक्षम होंगे; परिचय, एकल लागत का अर्थ, एकल लागत की परिभाषा, एकल लागत की विशेषताएँ और एकल लागत का उद्देश्य । उत्पादन की इकाइयों द्वारा लागत का एक ऑपरेशन लागत विधि और उत्पादन जहां एक समान और एक निरंतर संबंध है, उत्पादन की इकाइयां समान हैं और लागत इकाइयां भौतिक और प्राकृतिक हैं।

यह आलेख एकल लागत के विषय की व्याख्या करता है: परिचय, अर्थ, परिभाषा, विशेषताएँ और उद्देश्य।

उस अवधि के दौरान उत्पादित इकाइयों की संख्या द्वारा एक निश्चित अवधि के दौरान कुल लागत को विभाजित करके प्रति Single Costing (एकल लागत) निर्धारित करता है। लागत करने की यह विधि आम तौर पर अपनाई जाती है जहां एक उपक्रम केवल एक प्रकार के उत्पाद या एक ही तरह के दो या अधिक उत्पादों के उत्पादन में संलग्न होता है, लेकिन अलग-अलग ग्रेड या गुणवत्ता के होते हैं। जिन उद्योगों में लागत का यह तरीका उपयोग होता है, वे हैं डेयरी उद्योग, पेय पदार्थ, कोलियरीज़, चीनी मिलें, सीमेंट कार्य, ईंट-कार्य, पेपर मिल इत्यादि।

एकल लागत का अर्थ:

एकल या यूनिट या आउटपुट लागत, लागत की वह विधि है जिसमें निरंतर निर्माण गतिविधि में एकल उत्पाद की प्रति यूनिट लागत का पता लगाया जाता है। प्रत्येक एकल या प्रति यूनिट, लागत उत्पादन की कुल उत्पादन लागत को कई इकाइयों द्वारा विभाजित करके गणना करती है।

इस विधि को “एकल लागत (Single Costing)” के रूप में जाना जाता है क्योंकि उद्योग इस पद्धति के निर्माण को अपनाते हैं, ज्यादातर मामलों में, उत्पाद की एक ही किस्म। इस पद्धति को “यूनिट लागत (Unit Costing)” के रूप में भी जाना जाता है, न केवल कुल आउटपुट की लागत, बल्कि इस पद्धति के तहत आउटपुट की प्रति यूनिट लागत का भी पता चलता है। इस पद्धति के तहत लागत इकाइयाँ समान हैं। इस विधि को “आउटपुट लागत (Output Costing)” भी कहा जाता है, क्योंकि किसी उत्पाद के कुल आउटपुट के लिए लागत का पता लगाया जाता है।

एकल लागत की परिभाषा:

नीचे दिए गए परिभाषाएँ हैं;

J.R. Batliboi के अनुसार,

“एकल या आउटपुट लागत प्रणाली का उपयोग उन व्यवसायों में किया जाता है जहां एक मानक उत्पाद निकला है और यह उत्पादन की एक मूल इकाई की लागत का पता लगाने के लिए वांछित है।”

Institute of Cost and Management Accountants, लंदन,

“आउटपुट लागत एक बुनियादी लागत पद्धति है जो लागू होती है, जहां सामान या सेवाएं निरंतर या दोहराए जाने वाले संचालन या प्रक्रियाओं की एक श्रृंखला के परिणामस्वरूप होती हैं, जो कि अवधि के दौरान उत्पादित इकाइयों पर औसत होने से पहले शुल्क लिया जाता है।”

उपरोक्त परिभाषाओं से, यह स्पष्ट है कि Single Costing के तहत लागत का एक तरीका है। जिसमें एकल उत्पाद की लागत होती है, जो निरंतर विनिर्माण गतिविधि द्वारा उत्पन्न होती है। हालांकि उत्पाद की एक ही किस्म की लागत के इस तरीके के तहत विनिर्माण होता है। यह आकार, ग्रेड, रंग आदि के विषय में भिन्न हो सकता है। उद्योगों की मिसाल जो लागत के इस तरीके का उपयोग करते हैं; ईंट, चीनी, कपड़ा, कोयला, सीमेंट, मछली पालन, खाद्य डिब्बाबंदी, खदान, वृक्षारोपण उद्योग, आदि।

अतिरिक्त व्याख्या:

इस प्रकार यह लागत उन निर्माण संगठनों में लागत निर्धारण के लिए अपनाती है। जो केवल एक प्रकार के उत्पाद या एक ही तरह के दो या दो से अधिक उत्पादों के उत्पादन में संलग्न है, लेकिन अलग-अलग ग्रेड या गुणों के? यह विधि खानों, खदानों, तेल ड्रिलिंग जैसे उद्योगों में उपयोग करती है; ब्रुअरीज, सीमेंट वर्क्स, ईंट-वर्क्स, .सुगर मिल्स, स्टील निर्माण और एल्यूमीनियम उत्पाद, आदि।

उन सभी उद्योगों में जहां एकल लागत का उपयोग होता है, लागत की एक मानक या प्राकृतिक इकाई है। उदाहरण के लिए, कोलियरियों में एक टन कोयला, ईंट-कार्यों में एक हजार ईंट, चीनी उद्योग में एक क्विंटल चीनी, सीमेंट उद्योग में सीमेंट का एक टन आदि। Single Costing में, उत्पादन की लागत आमतौर पर तैयारी के बाद पता चलती है। लागत पत्रक या लागत विवरण।

एकल लागत: अर्थ, विशेषताएँ और उद्देश्य (Single Costing Hindi) #Pixabay. एकल लागत का उपयोग करने वाले उद्योगों की विशेषता या विशेषताएं:

निम्नलिखित उद्योगों की विशेषताएं या विशेषताएँ हैं जहां एकल लागत पद्धति का उपयोग किया जाता है:

- आउटपुट की प्रति यूनिट लागत, एकल के तहत निर्धारित की जाती है। लागत प्रबंधन को विभिन्न अवधियों के बीच और एक ही उद्योग के भीतर विभिन्न फर्मों के बीच वास्तविक तुलना करने में सक्षम बनाता है, क्योंकि आउटपुट की इकाई विभिन्न अवधियों के बीच और एक ही उद्योग के भीतर विभिन्न फर्मों के बीच एक सामान्य कारक है।

- लागत की समानता इस पद्धति की एक महत्वपूर्ण विशेषता है। यही है, इस पद्धति के तहत, समान लागत इकाइयों में समान लागत होगी।

- उत्पादन बड़े पैमाने पर है और निरंतर है।

- उत्पादन की इकाइयाँ समरूप और समरूप हैं।

- यह उन लागतों को अपनाने की पद्धति है, जहां एकल उत्पाद का उत्पादन होता है। या, एक ही उत्पाद के कुछ ग्रेड निर्माण की निरंतर प्रक्रिया द्वारा केवल आकार, आकार या गुणवत्ता में भिन्न होते हैं। उत्पादन या उत्पादन की इकाइयाँ समान हैं और इकाइयों की लागत भौतिक और प्राकृतिक है।

- लागत इकाइयां भौतिक और प्राकृतिक हैं और माप की सुविधाजनक इकाई में व्यक्त होने में सक्षम हैं।

- यह विधि लागत के सभी तरीकों में से सबसे सरल विधि है; इस अर्थ में कि लागत संग्रह और लागत का पता लगाना काफी सरल है।

- ज्यादातर मामलों में, माप की इकाई लागत इकाई भी है, अर्थात, एक इकाई (टीवी, रेडियो, कैमरा के मामले में), 1,000 इकाइयाँ (ईंटों के मामले में), एक सकल (पेंसिल के मामले में,) स्लेट, बोल्ट और नट), एक लीटर (पेंट के मामले में), एक टन (कोयला, सीमेंट और स्टील के मामले में), एक गठरी (कपास के मामले में), आदि।

एकल लागत के उद्देश्य:

यह एकल लागत की एक बहुत ही सरल विधि है, इसके प्रमुख उद्देश्य इस प्रकार हैं;

- उत्पादन की प्रति इकाई लागत का पता लगाने के लिए उत्पादन की कुल लागत को उत्पादित इकाइयों की संख्या से विभाजित करके।

- भविष्य के लिए उत्पादन की प्रति इकाई लागत का अनुमान लगाना और उत्पादन योजना को सुविधाजनक बनाना।

- निविदाओं को तैयार करने और बिक्री मूल्य तय करने में सहायता।

- दो लेखा अवधि के उत्पादन की लागत की तुलना की सुविधा के लिए।

- किसी भी दो अवधियों की लागत के तुलनात्मक अध्ययन के माध्यम से उत्पाद की लागत को नियंत्रित करना। या, पूर्व-निर्धारित मानक लागत के साथ वास्तविक लागतों की तुलना।

- प्रकृति द्वारा व्यय का विश्लेषण, उन्हें लागत के तत्व में वर्गीकृत करें और जानें। हद है कि लागत का प्रत्येक तत्व कुल लागत में योगदान देता है।

- उत्पादन के लाभ या हानि का पता लगाने के लिए।

-

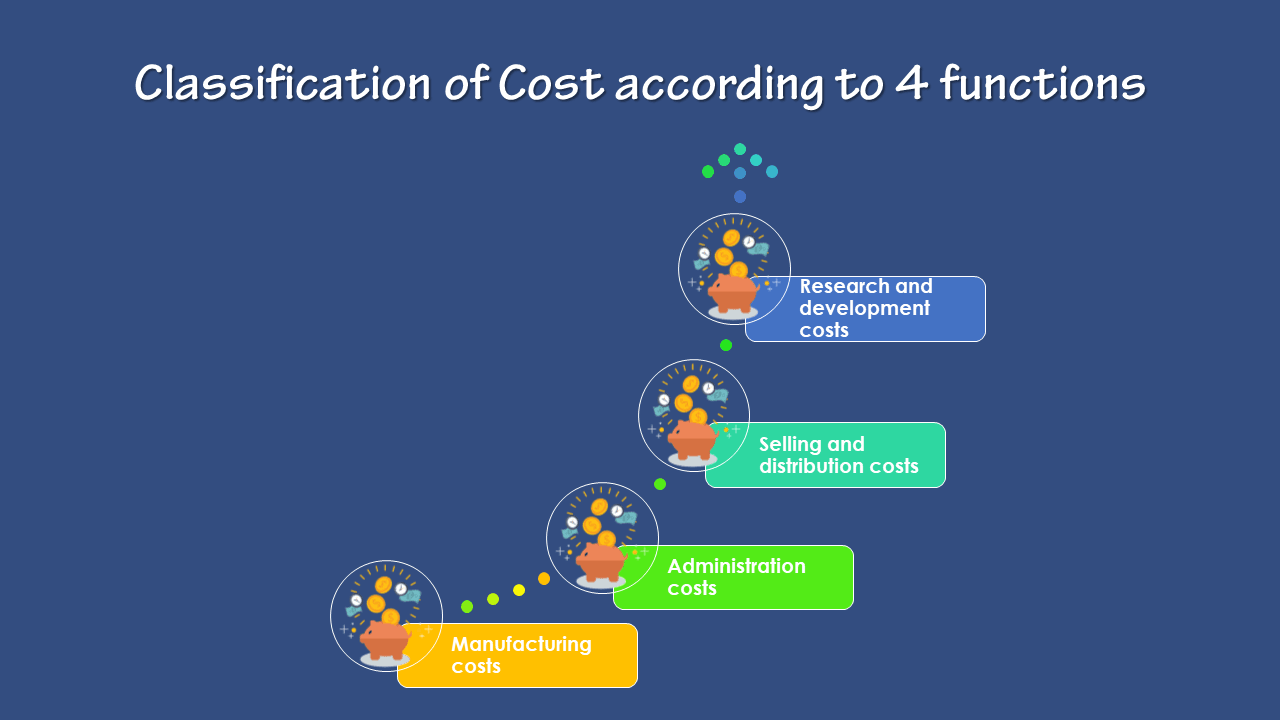

How to the Classification of Cost according to 4 functions?

Classification of Cost according to 4 functions: This is a traditional classification. A business has to perform several functions like manufacturing, administration, selling, distribution, and research.

This article explains the topic of the Classification of Cost according to 4 functions.

Cost may have to ascertain for each of these functions.

On this basis, costs are classifying into the following groups:

How to the Classification of Cost according to 4 functions? Manufacturing costs:

This is the cost of the sequence of operations. Which begins with supplying materials, labor, and services and ends with the completion of production. What are the manufacturing costs? Manufacturing costs are the costs of materials plus the costs to convert the materials into products. Manufacturing costs are the costs incur during the production of a product.

The costs are typically present in the income statement as separate line items. An entity incurs these costs during the production process. Direct material is the materials uses in the construction of a product. Direct labor is that portion of the labor cost of the production process that assigns to a unit of production. Manufacturing overhead costs are applying to units of production based on a variety of possible allocation systems. Such as by direct labor hours or machine hours incurred.

Administration costs:

This is general administrative cost and includes all expenditure incurs in formulating the policy, directing the organization and controlling the operations of an undertaking. Which is not directly related to production, selling and distribution, research and development activity or function.

Define administrative costs as the costs not directly related to operations. Generally, they are incurring in the process of directing a company. These costs, though indirect, are still important because they assist those who operate and sell company products by making their work more efficient.

Selling and distribution costs:

Selling cost is the cost of seeking to create and simulating demand and securing orders. Distribution cost is the cost of a sequence of operations. This begins with making the packed product available for despatch and ends with making the reconditioned returned empty package for re-use. There are some overhead about them;

- What is Selling Overhead? Selling overhead is the indirect expenses incur for seeking to create and stimulate demand for the product and up to the stage of securing orders.

- What is Distribution Overhead? Distribution overhead is the expenses incurred in connection with the execution of an order. It begins with making the packed product available for dispatch and ends with making the reconditioned empty package, if any, available for re-use.

The various items included in manufacturing administrative, selling and distribution costs ate available in Table:

Functional Classification of Costs – Table. Research and development costs:

Research cost is the cost of searching for new or improved products or methods. It comprises wages and salaries of research staff, payments to outside research organizations, materials used in laboratories and research departments, etc. After completion of research, the management may decide to produce a new improved product or to employ a new or improved method.

Development cost is the cost of the process which begins with the implementation of the decision to produce a new product or to employ a new or improved method and ends with the commencement of formal production of that product or by that method. Pre-production cost is that part of the development cost which incurs in making in trial production run preliminary to formal production.

-

What is the Cost concepts in Cost accounting? Discussion

Top 17 Cost concepts in Cost accounting: They are; 1) Product and period costs, 2) Common and joint costs, 3) Short-run and long-run costs, 4) Past and future costs, 5) Controllable and non-controllable costs, 6) Replacement and Historical Costs, 7) Escapable and unavoidable costs, 8) Out of pocket and Book Costs, 9) Imputed and Sunk Costs, 10) Relevant and Irrelevant Costs, 11) Opportunity and Incremental Costs, 12) Conversion cost, 13) Committed cost, 14) Shutdown and Abandonment costs, 15) Urgent and Postponable costs, 16) Marginal cost, and 17) Notional cost.

Here are important topic or questions is Discussion; What is the Cost concepts in Cost accounting?

A clear understanding of various cost concepts is essential for the study of cost accounting and cost systems.

Top 17 Cost concepts in Cost accounting – List The description of these cost concepts follows now for cost accounting.

1] Product and period costs:

First Cost concepts; The product cost is the aggregate of costs that are associated with a unit of product. Such Costs may or may not include an element of overheads depending upon the type of costing system in force-absorption or direct. Product costs are related to goods produce or purchase for resale and are initially identifying as part of the inventory.

These products or inventory costs become expenses in the form of the cost of goods sold only when the inventory sales. Product cost associated with the unit of output. The costs of inputs informing the product viz., the direct material, direct labor, factory overhead constitute the product costs. The period cost is a cost that tends to be unaffecting by changes in the level of activity during a given period. What is the importance of Cost accounting?

The period cost associative with a period rather than manufacturing activity and these costs deduct as expenses during. The current period without have been previously classifying as product costs. Selling and distribution costs are period costs and are deducting from the revenue without their existence regard as part of the inventory cost.

2] Common and joint costs:

The common cost is an indirect cost that incurs for the general benefit of several departments or for the whole enterprise and which is necessary for present and future operations. The joint costs are the cost of either a single process or a series of processes. That simultaneously produce two or more products of significant relative sales value.

3] Short-run and long-run costs:

The short-run costs are costs that vary with the output when fixed plant and capital equipment remain the same and become relevant. When a firm has to decide whether or not to produce more in the immediate future. The long-run-costs are those which vary with the output when all input factors including plant and equipment vary and become relevant. When the firm has to decide whether to set up a new plant or to expand the existing one.

4] Past and future costs:

The past costs are actual costs incur in the past and are generally containing in the financial accounts. These costs report past events and the time lag between event and its reporting makes the information out of date and irrelevant for decision-making.

These costs will just act as a guide for the future course of action. The future costs are costs expecting to incur at a later date and are the only costs that matter for managerial decisions because they are subject to management control.

Future costs are relevant for managerial decision making in cost control, profit projections, appraisal of capital expenditure, the introduction of new products, expansion programs, and pricing, etc.

5] Controllable and non-controllable costs:

The concept of responsibility accounting leads directly to the classification of costs as controllable or uncontrollable. The controllable cost is a cost chargeable to a budget or cost center. Which can influence the actions of the person in whom control the center vests? It is always not possible to predetermine responsibility, because the reason for deviation from expected performance may only become evident later.

For example, excessive scrap may arise from inadequate supervision or latent defect in purchased material. The controllable cost is a cost that can influence and regulate during a given period by the actions of a particular individual within an organization. The controllability of cost depends upon the level of responsibility under consideration.

Direct costs are generally controllable by shop level management. The uncontrollable cost is a cost that is beyond the control of a given individual during a given period. The distinction between controllable and uncontrollable costs are not very sharp and may be left to individual judgment. Some expenditure which may uncontrollably on a short-term basis controllably on a long-term basis,

There are certain costs which are difficult to control due to the following reasons.

- Physical hazards arising due to flood, fire, strike, lockout, etc.

- Economic risks such as increased competition, change in fashion or model, higher prices of inputs, import restrictions, etc.

- Political risks like change in Government policy, political unrest, war, etc.

- Technological risk such as a change in design, know-how, etc.

6] Replacement and Historical Costs:

The Replacement costs and Historical costs are two methods for carrying assets in the balance sheet and establishing the amounts of costs that use to determine income.

- The Replacement cost is a cost at which material identical to that is to replace could purchase at the date of valuation (as distinct, from actual cost price at the date of purchase). The replacement cost is the cost of replacing an asset at any allow point of time either present or the future (excluding any element attributable to improvement).

- The Historical cost is the actual cost, determined after the event. Historical cost valuation states the costs of plant and materials, for example, at the price originally paid for them whereas replacement cost valuation states the costs at prices that would have to pay currently.

Costs reported by conventional financial accounts are based on historical valuations. But during periods of changing price level, historical costs may not be the correct basis for projecting future costs. Naturally historical costs must adjust to reflect current or future price levels.

7] Escapable and unavoidable costs:

The Escapable cost is an avoidable cost that will not incur if an activity does not undertakes or discontinue. The avoidable cost will often correspond-with variable costs. The avoidable cost can identify with an activity or sector of a business and which would avoid if that activity or sector did not exist. The escapable costs refer to costs that can reduce due to the contraction in the activities of a business enterprise. It is the net effect on costs that is important, not just the costs directly avoidable by the contraction. Examples:

- Closing an unprofitable branch house-storage costs of other branches and transportation charges would increase.

- Reducing credit sales costs estimated may be less than the benefits otherwise available.

Note: Escapable costs are different from controllable and discretionary costs.

8] Out of pocket and Book Costs:

The out of pocket cost is a cost that will necessitate a corresponding outflow of cash. Also, the costs involving cash outlay or payment to other parties term as out of pocket costs. Book costs are those which do not require current cash payments.

Depreciation is a notional cost in which no cash transaction involves. The distinction between out of pocket costs and book costs primarily shows how costs affect the cash position.

Out of pocket costs are relevant in some decision-making problems. Such as the fluctuation of prices during the recession, make or buy decisions, etc. Book-costs can convert into out of pocket costs by selling the assets and having the item on hire. Rent would then replace depreciation and interest.

9] Imputed and Sunk Costs:

The imputed cost is a cost that does not involve actual cash outlay. Which uses only for decision making and performance evaluation. Imputed cost is a hypothetical cost from financial accounting. Interest on capital is a common type of imputed cost. No actual payment of interest makes but the basic concept is that had the funds been investing elsewhere they would have to earn interest. Thus, imputed costs are a type of opportunity costs.

The Sunk costs are those costs that have been investing in a project and which will not recover if the project terminates. The sunk cost is one for which the expenditure has to take place in the past. This cost does not affect a particular decision under consideration. Sunk costs are always results of decisions accept in the past.

This, the cost cannot change by any decision in the future. Investment in plant and machinery as soon as it installs its cost is sunk cost and is not relevant for decisions. Amortization of past expenses e.g. depreciation is sunk cost. Sunk, costs will remain the same irrespective of the alternative selected.

Thus, it need not consider by the management in evaluating the alternatives as it is common to all of them. It is important to observe that an unavoidable cost may not be a sunk cost. The Managing Director’s salary is generally unavoidable and also out of pocket but not sunk cost.

10] Relevant and Irrelevant Costs:

The relevant cost is a cost appropriate in aiding to make specific management decisions. Business decisions involve planning for the future and consideration of several alternative courses of action. In this process, the costs which are affecting by the decisions are future costs. Such costs call relevant costs because they are pertinent to the decisions in hand. The cost is saying to be relevant if it helps the manager in taking. The right decision in furtherance of the company’s objectives.

11] Opportunity and Incremental Costs:

The opportunity cost is the value of a benefit sacrifice in favor of an alternative course of action. It is the maximum amount that could obtain at any given point of time. If a resource was selling or put to the most valuable alternative use that would be practicable.

- The opportunity cost of a good or service measure in terms of revenue. Which could have been earning by employing that good or service in some other alternative uses. Opportunity cost can define as the revenue forgone by not making the best alternative use. Opportunity cost is the prospective change in cost following the adoption of an alternative machine process, raw materials, etc. It is the cost of opportunity lost by the diversion of an input factor from use to another.

- The incremental cost is the extra cost of taking one course of action rather than another. It also calls at different costs. The incremental cost is the additional cost due to a change in the level of nature of the business activity.

The change may take several forms e.g., changing the channel of distribution, adding a new machine, replacing a machine by a better machine, execution of export orders, etc. Incremental costs will be different in case of different alternatives. Hence, incremental costs are relevant to the management in the analysis of decision making.

12] Conversion cost:

The conversion cost is the cost incur for converting the raw material into the finished product. It refers to as the production cost excluding the cost of direct materials:

13] Committed cost:

The committed cost is a cost that primarily associates with maintaining the organization’s legal and physical existence over which management has little discretion. Also, the committed cost a fixed cost that results from the froth decision of the prior period.

The amount of committed cost as fixed by decisions. Which makes in the past and not subject to managerial control in the short-run? Since committed cost does not fluctuate with volume and remains unchanged until action takes to increase or reduce available capacity.

Committed cost does not present any problem in cost behavior analysis. Examples of committed costs are depreciation, insurance premium, rent, etc. This is an important Cost concept in accounting.

14] Shutdown and Abandonment costs:

The shutdown costs are the cost incur about the temporary closing of a department/division/enterprise. Such costs include those of closing as well as those of re-opening. Also, the shutdown costs asses as those costs which would incur in the event of suspension of the plant operation. And, which would save if the operations are continuing. Examples of such costs are the costs of sheltering the plant and equipment and construction of sheds for storing exposed property.

Further, additional expenses may have to incur when operations are restoring e.g.. Re-employment of workers may involve the cost of recruitment and training. The Abandonment cost is the cost incur in closing down. Also, A department or a division or in withdrawing a product or ceasing to operate in a particular sales territory etc.. The abandonment costs are the cost of retiring altogether a plant from service; Abandonment arises when there is a complete cessation of activities and creates a problem as to the disposal of assets.

15] Urgent and Postponable costs:

The urgent costs are those which must incur to continue operations of the firm. For example, the cost of material and labor must incur if production is to take place. The Postponable cost is that cost which can shift to the future with little or no effect on the efficiency of current operations. These costs can postpone at least for some time, e.g., maintenance relating to building and machinery.

16] Marginal cost:

The marginal cost is the variable cost of one unit of a product or a service i.e., a cost that would avoid. If the unit did not produce or provide. In this context, a unit in usually either a single article or a standard measure such as a liter or kilogram. But may in certain circumstances be an operation, process or part of an organization.

They are the amount at any allow volume of output by which aggregate costs are changing. If the volume of output increases or decreases by one unit. It uses full Cost concepts in accounting.

The marginal costing technique is the process of ascertaining marginal costs and of the effects of changes in the volume of the type of output on profit by differentiating between fixed and variable costs.

17] Notional cost:

Final Cost concepts; The Constitutional or notional cost is hypothetical to take into account in a particular situation to re-present. As well as, the benefits enjoying by an entity in respect of which no actual expense incurs. Maybe you understand your misinformation of the cost concepts in cost accounting.

What is the Cost concepts in Cost accounting? Discussion.