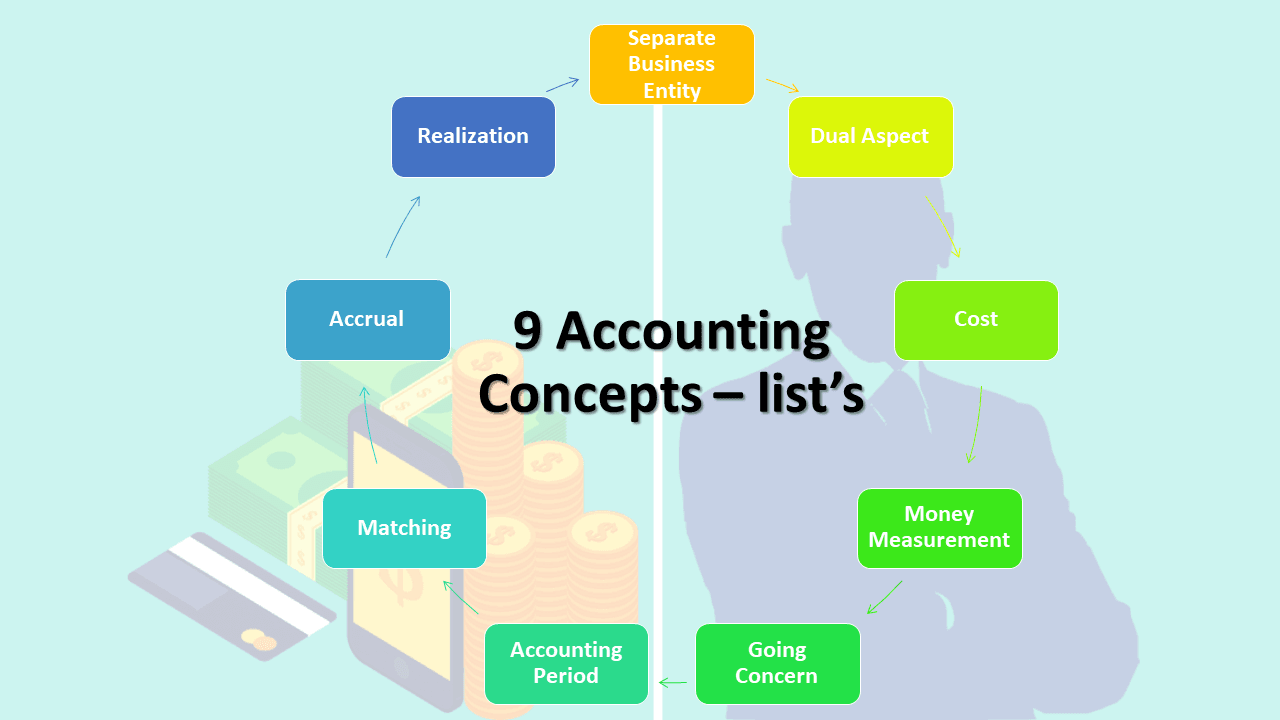

Accounting concepts; Accounting is the language of business. Business firms communicate their affairs and financial positions to the outsiders through the medium of accounting, which is the language of business in the form of financial statements. To make the language convey the same meaning to all interested parties, accountants have agreed on a number of concepts which they try to follow. 9 Accounting concepts; Separate Business Entity, Dual Aspect, Cost, Money Measurement, Going Concern, Accounting Period, Matching, Accrual, and Realization. Also, helpfull, What are the utility and types of Accounting?

Here are explaining What is Accounting concepts? their 9 Concepts explanation.

Accounting concepts can describe as something which signifies a general notion regarding accounting principle. The assumptions, so made, are most natural and are not forced ones. A concept is a self-evident proposition, i.e., something taken for granted. There is no authoritative list of these concepts.

The more important accounting concepts are briefly describing as follows:

- Separate Business Entity.

- Dual Aspect.

- Cost.

- Money Measurement.

- Going Concern.

- Accounting Period.

- Matching.

- Accrual, and.

- Realization.

Now, explain each one;

Separate Business Entity:

First Accounting concepts, Separate Business Entity; In accounting, we make a distinction between business and the owner. All the books of accounts record day to day financial transactions from the viewpoint of the business rather than from that of the owner. The proprietor is considered as a creditor to the extent of the capital brought in business by him.

For instance, when a person invests dollar 10000 into a business, it will treat that the business has borrowed that much money from the owner and it will show as a “liability” in the books of accounts of the business.

Similarly, if the owner of a shop were to take cash from the cash box for meeting certain personal expenditure, the accounts would show that cash had been reducing even though it does not make any difference to the owner himself. Thus, in recording a transaction the important question is how does it affect the business?

For example;

If the owner puts cash into the business, he has a claim against the business for capital brought in. In so far, as a limited company is concerned, this distinction can easily maintain because a company has a legal entity like a natural person it can engage itself in economic activities of buying, selling, producing, lending, borrowing and consuming of goods and services. However, it is difficult to show this distinction in the case of sole proprietorship and partnership.

Nevertheless, accounting still maintains the separation of business and owner. It may note that it is only for accounting purpose that partnerships and sole proprietorship are treated as separate from the owners, though the law does not make such distinction. In fact, the business entity concept is applied to make it possible for the owners to assess the performance of their business and performance of those who manage the enterprise. The managers are responsible for the proper use of funds supplied by owners, banks, and others.

Dual Aspect:

Second Accounting concepts, Dual Aspect; Financial accounting records all the transactions and events involving financial element. Each of such transactions requires two aspects to record. The recognition of these two aspects of every transaction knows as a dual aspect analysis. According to this concept, every business transactions has a dual effect.

For example;

If a firm sells goods of dollar 5,000 this transaction involves two aspects. One aspect is the delivery of goods and the other aspect is immediate receipt of cash (in the case of cash sales). In fact, the term “double-entry” bookkeeping has come into vogue and in this system, the total amount debited always equals the total amount credited. It follows from “dual aspect concept” that at any point of time owners equity and liabilities for any accounting entity will equal to assets own by that entity.

This idea is fundamental to accounting and could express the following qualities:

Assets = Liabilities + Owners Equity …(1)

Owners Equity = Assets – Liabilities …(2)

The above relationship is known as the “Accounting Equation”. The term “Owners Equity” denotes the resources supplied by the owners of the entity while the term “liabilities” denotes the claim of outside parties such as creditors, debenture-holders, bank against the assets of the business. Assets are the resources owned by a business. The total of assets will be equal to the total of liabilities plus owners capital because all assets of the business are claiming by either owners or outsiders.

Cost:

The third Accounting concepts, Cost; The term “assets” denotes the resources land building, machinery, etc. owned by a business. The money values that are assigning to assets are deriving from the cost concept. According to this concept, an asset ordinarily enters on the accounting records at the price paid to acquire it.

For example;

If a business buys a plant for dollar 50000 the asset would record in the books at dollar 50000, even if it’s the market value at that time happens to be dollar 60000. Thus, assets are recording at their original purchase price and this cost is the basis for all subsequent accounting for the business. The assets shown in the financial statements do not necessarily indicate their present market values.

The term “book value” uses for the amount shown in the accounting records. The cost concept does not mean that all assets remain on the accounting records at their original cost for all times to come. The asset may systematically reduce its value by charging “depreciation”. Which will discuss in detail in a subsequent lesson? Depreciation has the effect of reducing the profit of each period.

The prime purpose of depreciation is to allocate the cost of an asset over its useful life and not to adjust its cost. However, a balance sheet based on this concept can be very misleading as it shows assets at a cost even when there is a wide difference between their costs and market values. Despite this limitation, you will find that the cost concept meets all the three basic norms of relevance, objectivity, and feasibility.

Money Measurement:

Fourth Accounting concepts, Money Measurement; In accounting, only those business transactions are recording which can express in terms of money. In other words, a fact or transaction or happening which cannot express in terms of money is no record in the accounting books. As money accepts not only as a medium of exchange but also as a store of value. It has a very important advantage since a number of assets and equities.

Which are otherwise different, can measure and express in terms of a common denominator. We must realize that this concept imposes two severe limitations. Firstly, there are several facts which though very important to the business, cannot record in the books of accounts because they cannot express in money terms.

For example;

General health condition of the Managing Director of the company, working conditions in which a worker has to work, sales policy pursued by the enterprise, quality of product introducing by the enterprise, though exert a great influence on the productivity and profitability of the enterprise, are not recorded in the books.

Similarly, the fact that a strike is about to begin because employees are dissatisfying with the poor working conditions in the factory will not record even though this event is of great concern to the business. You will agree that all these have a bearing on the future profitability of the company. Secondly, the use of money implies that we assume a stable or constant value of the rupee. Taking this assumption means that the changes in the money value in future dates are conveniently ignored.

Question example;

A piece of land purchased in 1990 for dollar 20000 and another bought for the same amount in 1998 are recording at the same price, although the first purchased in 1990 may be worth two times higher than the value recorded in the books because of the rise in land prices. In fact, most accountants know fully well that purchasing power of rupee does change but very few recognize this fact in accounting books and make allowance for changing price level.

Going Concern:

The fifth Accounting concepts, Going Concern; Accounting assumes that the business entity will continue to operate for a long time in the future unless there is good evidence to the contrary. The enterprise views as a going concern, that is, as continuing in operations, at least in the foreseeable future.

In other words, there is neither the intention nor the necessity to liquidate the particular business venture in the predictable future. Because of this assumption, the accountant while valuing the assets does not take into account the forced sale value of them. In fact, the assumption that the business does not expect to liquidate in the foreseeable future establishes the basis for many of the valuations and allocations in accounting.

For example;

The accountant charges depreciation on fixed assets. It is this assumption which underlies the decision of investors to commit capital to the enterprise. Only on the basis of this assumption accounting process can remain stable and achieve. The objective of correctly reporting and recording on the capital invested. The efficiency of management, and the position of the enterprise as a going concern.

However, if the accountant has good reasons to believe that. The business or some part of it is going to liquidate or that it will cease to operate (say within six-month or a year). Then the resources could report at their current values. If this concept not follows, the International Accounting Standard requires. The disclosure of the fact in the financial statements together with reasons.

Accounting Period:

Sixth Accounting concepts, Accounting Period; this concept requires that the life of the business should divide into appropriate segments for studying. The financial results show by the enterprise after each segment. Although the results of operations of a specific enterprise can know precisely only after the business has ceased to operate. Its assets have been selling off and liabilities paid off, the knowledge of the results periodically is also necessary.

Those who are interesting in the operating results of business obviously cannot wait till the end. The requirements of these parties force the businessman “to stop” and “see back” how things are going on. Thus, the accountant must report for the changes in the wealth of a firm for short time periods. A year is the most common interval on account of prevailing practice, tradition and government requirements.

Some firms adopt the financial year of the government, some other calendar year. Although a twelve-month period adopts for external reporting, a shorter span of the interval, say one month or three months applies for internal reporting purposes. This concept poses difficulty for the process of allocation of long term costs.

All the revenues and all the cost relating to the year in operation have to take into account while matching the earnings and the cost of those earnings for any accounting period. This holds good irrespective of whether or not they have been receiving in cash or paid in cash. Despite the difficulties which stem from this concept, short term reports are of vital importance to owners, management, creditors and other interested parties. Hence, the accountants have no option but to resolve such difficulties.

Matching:

The seventh Accounting concepts, Matching; This concept bases on the accounting period concept. In reality, we match revenues and expenses during the accounting periods. Matching is the entire process of periodic earnings measurement, often described as a process of matching expenses with revenues.

In other words, income made by the enterprise during a period can measure only. When the revenue earns during a period compares with the expenditure incurred for earning that revenue. Broadly speaking revenue is the total amount realized from. The sale of goods or provision of services together with earnings from interest, dividend, and other items of income.

Expenses are a cost incurred in connection with the earnings of revenues. Costs incur do not become expenses until the goods or services in question are exchanging. Cost is not synonymous with the expense since the expense is a sacrifice made. Resource consume in relation to revenues earns during an accounting period. Only costs that have expired during an accounting period are considering as expenses.

For example;

If a commission is paid on January 2002, for services enjoyed in November 2001, that commission should take as the cost for services rendered in November 2001. On account of this concept, adjustments are made for all prepaid expenses, outstanding expenses, accrued income, etc, while preparing periodic reports.

Accrual:

Eighth Accounting concepts, Accrual; It generally accepts in accounting that the basis of reporting income is accrual. Accrual concept makes a distinction between the receipt of cash and the right to receive it and the payment of cash and the legal obligation to pay it. This concept provides a guideline to the accountant as to how he should treat the cash receipts and the right related thereto.

Accrual principle tries to evaluate every transaction in terms of its impact on the owner’s equity. The essence of the accrual concept is that net income arises from events that change the owner’s equity in a specified period. And, that these are not necessarily the same as the change in the cash position of the business. Thus it helps in proper measurement of income.

Realization:

Final Accounting concepts, Realization is technically understood as the process of converting non-cash resources and rights into money. As the accounting principle, it uses to identify precisely the amount of revenue to recognize and the amount of expense to match to such revenue for the purpose of income measurement.

According to realization, concept revenue recognizes when a sale makes. The sale is considering to make at the point. When the property in goods passes to the buyer and he becomes legally liable to pay. This implies that revenue generally realizes when goods are delivering or services are rendering. The rationale is that delivery validates a claim against the customer.

However, in the case of long-run construction contracts revenue often recognizes on the basis of a proportionate or partial completion method. Similarly, in the case of long-run installment sales contracts. Revenue regards as realize only in proportion to the actual cash collection. In fact, both these cases are exceptions to the notion. That exchange needs to justify the realization of revenue.

Leave a Reply